The word recession is very common today. Although the slowdown in the world economy has already been pointed out earlier, it has been officially started today that the world is afraid of recession. Here is why.

The inversion of the yield curve in the United States and in the United Kingdom is the main event that has increased the fear of recession and thus increased risk aversion, drop in the stock market and a rebound in gold and silver prices. This is the first inversion since the financial crisis a decade ago. It was then that the inversion of the yield curve heralded the arrival of the financial crisis. Now investors are also afraid of that.

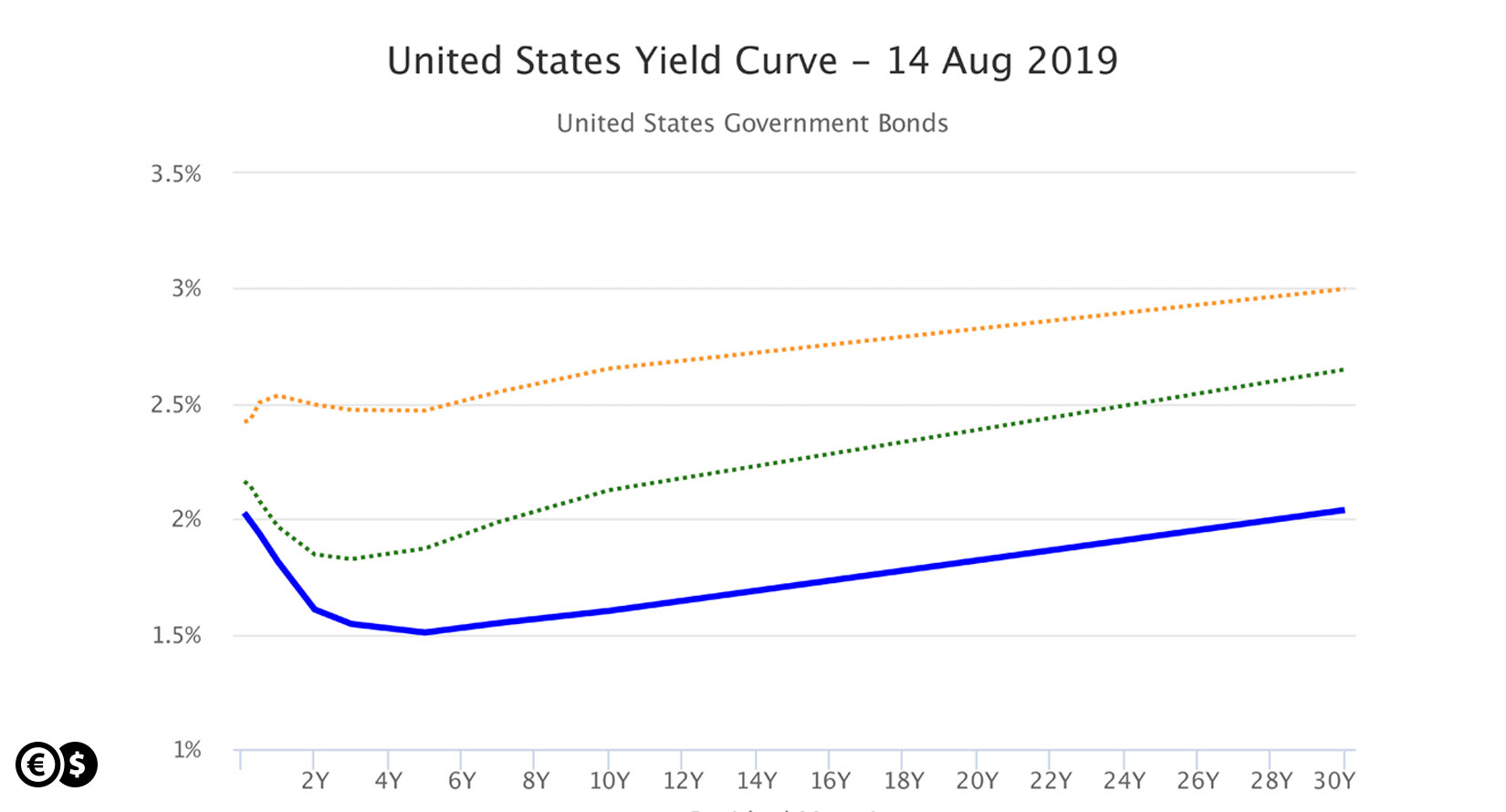

The yield curve is a graphic reflection of a given country's debt yield. From bonds with the shortest maturity to bonds with the longest maturity. The benchmark for the yield curve was to compare the interest rate on 10-year bonds with 2-year bonds. Under normal circumstances, the interest rate on 10-year bonds is higher than 2-year bonds because investors demand a higher risk premium for borrowing money for 10 years than for 2 years. The term of two years is more predictable for an investor than ten.

United States yield curve. Source: http://www.worldgovernmentbonds.com

However, it happens like now that investors will receive higher interest for investing in 2-year bonds than in 10-year bonds. This also makes borrowing money more expensive in the short term than in the long run. In these circumstances, companies often feel that financing their business is more expensive, and management tends to temper or put off investment. Consumer loan costs are also rising and consumer spending is slowing down. Ultimately, the economy is shrinking and unemployment is rising.

Such an event in the recent 50-year history of the United States has always been ahead of the recession on average 18 months in advance. In other words, in a year and a half from now on, there have been five recessions on average in the last five decades. The yield curve also inverted in the UK. If we add shrinking Germany's GDP in the second quarter and very poor data from China, then we have a recipe for a scary mix for the investors.

A mixture that also causes capital outflow from Poland, which can be seen in the falling WIG20 and the zloty depreciating dramatically. Germany and Great Britain are countries that account for one third of Poland's exports. If there is a recession there, then Poland's exports will be very threatened, and thus the entire economy.

For the yield curve to reverse again, investors would have to see the chances of improving economic growth and inflation, and central banks would have to cut interest rates in a panic to quickly lower interest rates in the short term.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.