The cannabis market is experiencing a real renaissance. Legalisation in one of the key economies has contributed significantly to the explosive growth of the sector. In Germany, the possession and cultivation of cannabis at home has been decriminalised since 1 April this year. Adults over the age of 18 can carry up to 25 grams of cannabis and cultivate up to three plants. From 1 July, non-commercial cannabis clubs will be allowed to operate and will gain the ability to supply up to 500 members with up to 50 grams of cannabis per month per person. This is a landmark event for cannabis businesses. So let's take a look at the industry leaders.

Table of contents:

- Is the drought in the cannabis market coming to an end?

- Canopy Growth is growing by more than 200%.

- Tilray Brands, Inc.

- Is it worth investing in cannabis companies?

Is the drought in the cannabis market coming to an end?

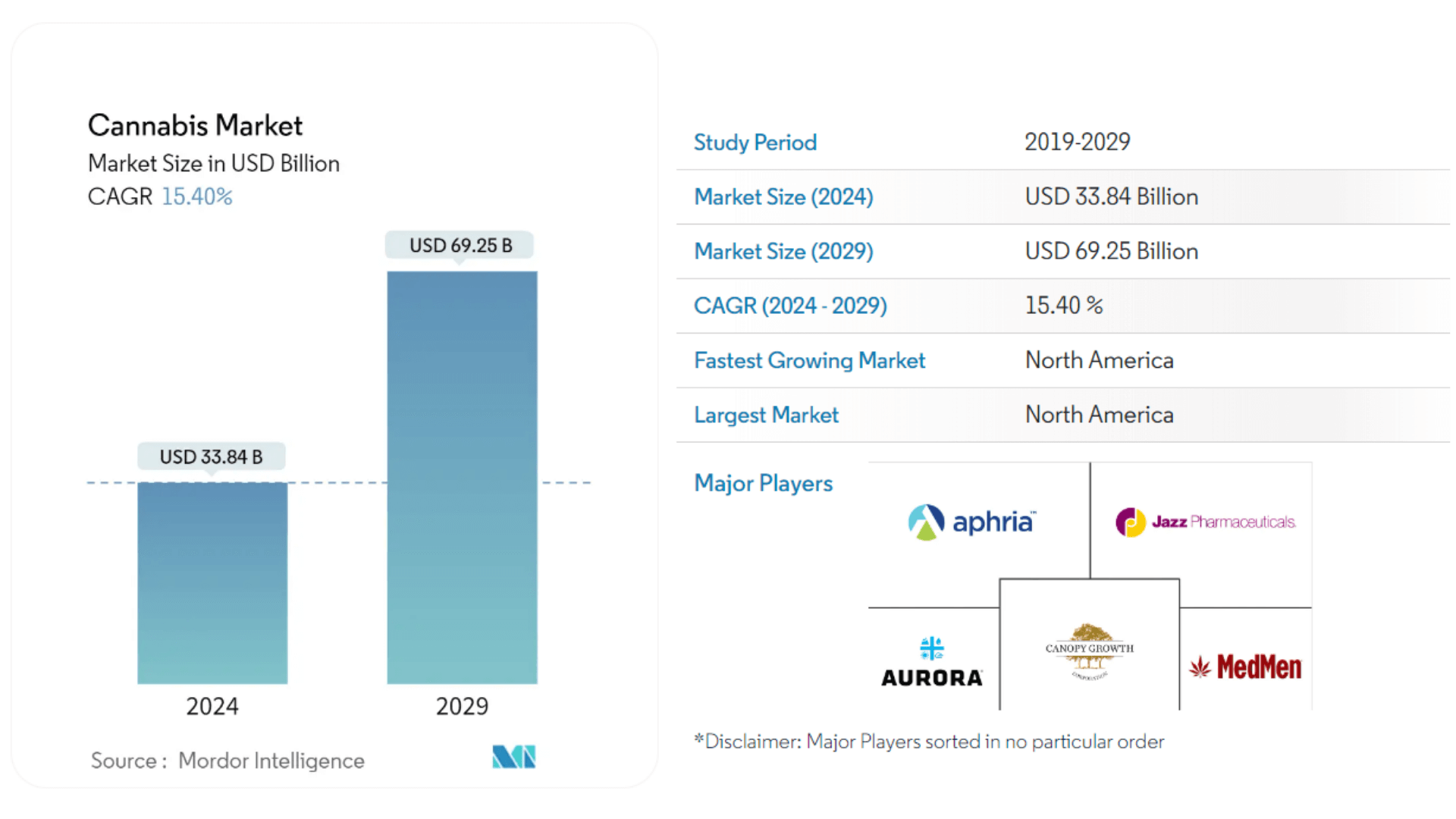

A report by Mordor Intelligence indicates that the cannabis market is estimated to be worth US$33.84 billion in 2024 and is forecast to grow to US$69.25 billion by 2029, representing an average annual growth rate of 15.40%. The cannabis industry offers products for medical and non-medical use. Both categories appear to have favourable prospects ahead due to increasing tolerance and the official legalisation of cannabis worldwide.

Source: Mordor Intelligence

Medical cannabis represents a significant part of the cannabis market. Many countries (Australia, Canada, Chile, Colombia, Germany, Greece, Israel, Italy, the Netherlands, Peru, Poland, Portugal, Thailand, the UK and Uruguay) have legalised the use of cannabis for medical purposes. In June 2022. Thailand withdrew cannabis and hemp from the list of category five drugs, decriminalising these substances, allowing Thais to produce and sell cannabis for medical purposes, with the hope of establishing Thailand as a herbal centre in Southeast Asia.

Marijuana for non-medical use is legal in 19 states, 2 US territories and the District of Columbia. 37 states, 4 US territories and the District of Columbia have also approved its medical use. More states are expected to join this trend in the coming years, given the growing demand for cannabis and its medicinal properties.

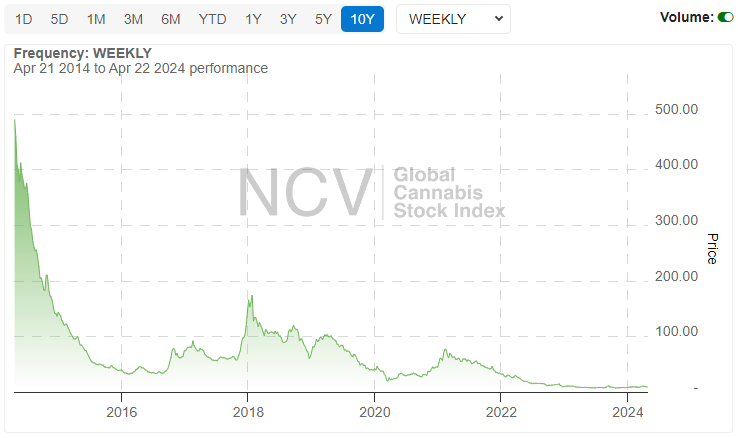

Despite its growth and increasing popularity, the sector's stock has experienced difficulties. Since 2014, after an initial boom, the value of the index of companies in this sector has fallen by 98%. Will Germany's legalisation of cannabis reverse this trend? The answer will be found by looking at the industry leaders.

Source: NewCannabisVentures

Canopy Growth is growing by more than 200%.

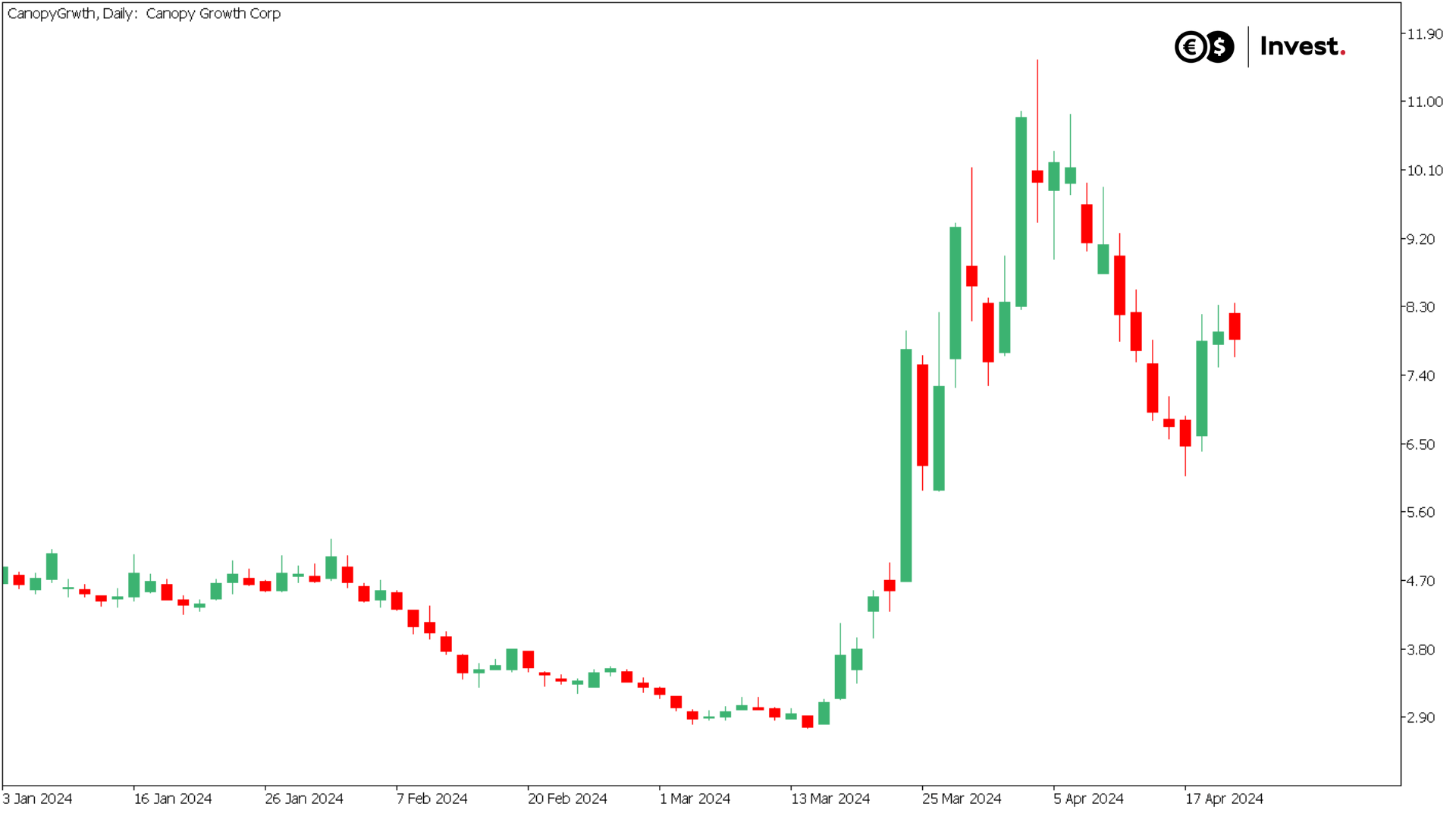

Despite the extremely negative sentiment in recent years following the adoption of the law in Germany, the largest hemp companies have gained significantly. One of the growth leaders is Canopy Growth, which offers a wide range of hemp products, including dried, oils, hemp drinks and various food products. This company is also researching and developing new medical and non-medical products. Hemp is a major part of Canopy Growth's business, so it contributes significantly to the company's overall revenue. The company's shares at their peak gained more than 300% after the German law was passed.

Source: Conotoxia MT5, CanopyGrowth, Daily

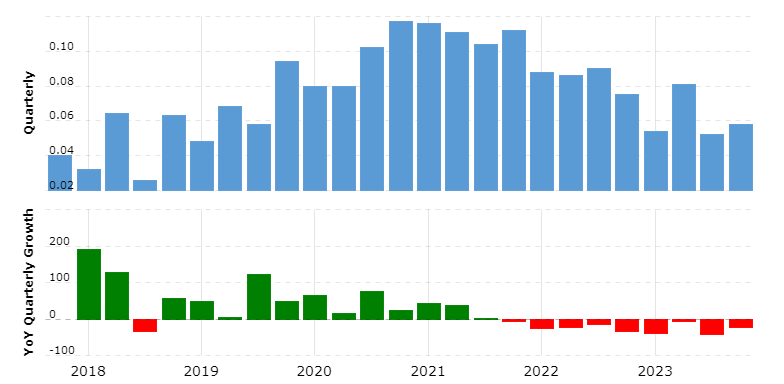

It appears that the opening of such a large market is the last chance for a company whose revenues have regularly declined year on year and which has generally failed to record a net profit over the past six years. This has led to an increase in the debt-to-equity ratio, which has risen from 0 to 0.96 over the past six years.

Source: Macrotrends, Revenue CanopyGrowth

Tilray Brands, Inc.

Tilray produces a wide range of hemp products, including dried flowers, hemp oils and food products. The company also offers medical products. Tilray (following its merger with Aphria) has become one of the largest players in the global hemp market.

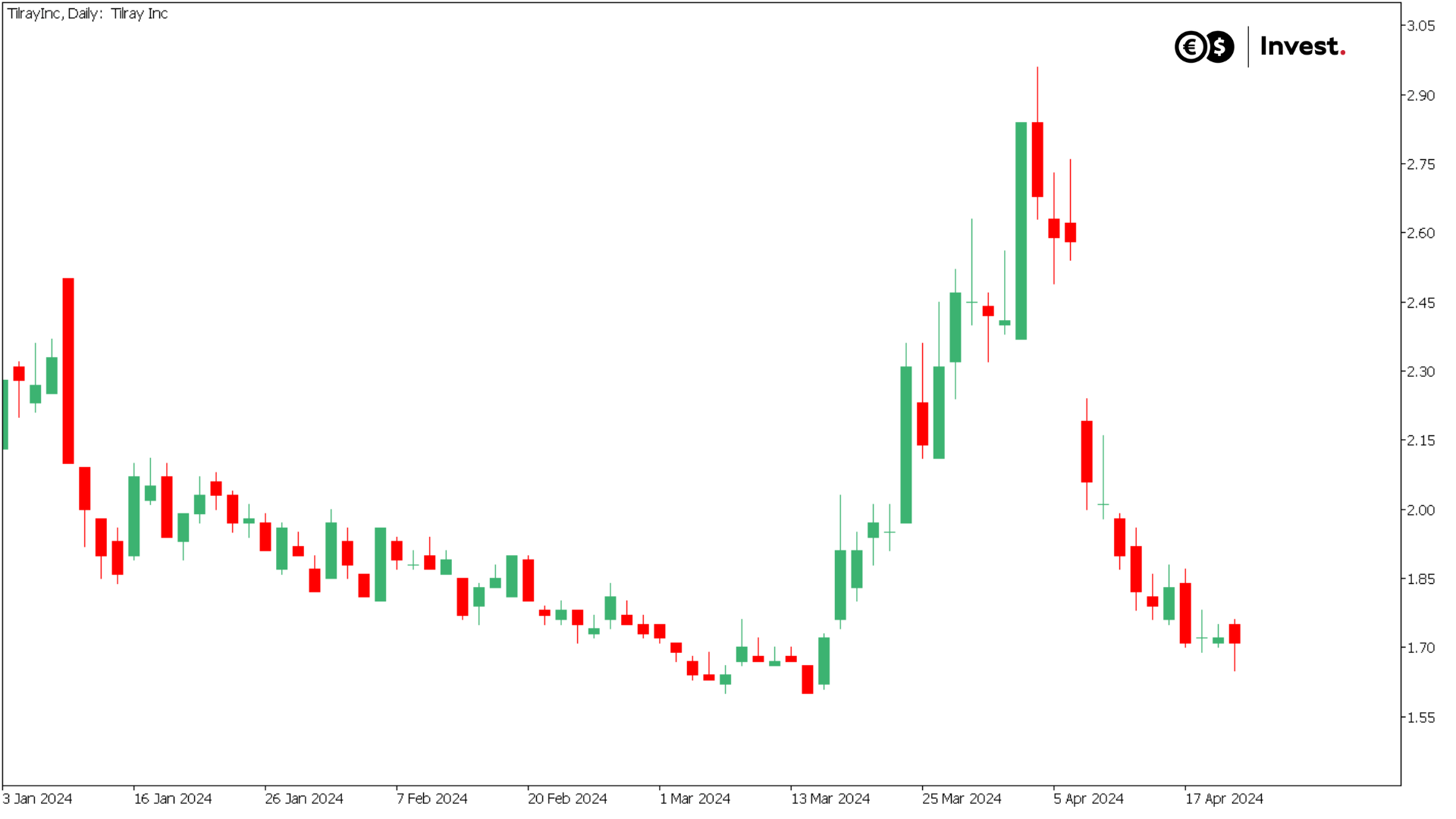

Its shares reacted positively to news of legalisation in Germany, rising by 75% before falling to zero.

Source: Conotoxia MT5, TilrayInc, Daily

Tilray Brands, in contrast to Canopy Growth, reported record revenues in Q2 2024, a 34% increase on the previous year. The company enjoys a leadership position in the global cannabis market, being number one in terms of market share in Canada and leading the medical cannabis segment in Europe. Tilray is focused on increasing its market share, particularly in the medical cannabis segment in Europe, by leveraging its cultivation and distribution operations. Despite Tilray's all-time record sales, the company has not recorded a net profit in recent years.

Is it worth investing in cannabis companies?

There is no denying that the opening of the German market may represent a new deal for the cannabis industry. Despite the impressive recent increases, it is worth remembering the words of New York University professor Aswath Damodaran: "keep your eyes on the price". The value of any company is today's value of the company's future earnings, and holding on to losses for too long can lead to an increase in debt or the issuance of new shares, which in most cases will negatively impact the outcome of our investment.

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,48% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.