From OPEC's monthly oil market report, we could learn about crude production, demand, prices and stocks, and analyse trends from economies around the world. The document also allows us to understand what might be happening in the fuel market. What could we learn from the latest edition of the report?

Will there be no crisis?

The average global oil demand forecast for 2023 is 101.77 mb/d, an increase of 2.31% over the previous year. The cartel sets these figures based on, among other things, contracted long-term oil supply contracts for various countries. What may seem interesting, among the markets expected to have the smallest increase in demand are: Europe (up 0.24% year-on-year), Russia (up 0.51% year-on-year) and the United States (up 0.74% year-on-year). Based on this information, we could expect possible difficulties in the European market this year.

The DAX (DE40) index, the largest in the German economy, currently seems to look particularly attractive to investors due to falling energy prices.

Source: Conotoxia MT5, DE40, Daily

Among the markets that may achieve the highest rate of oil demand growth are: India (up 4.84% y-o-y), Africa (4.35% y-o-y) and Middle East economies (4.05% y-o-y). For this reason, the iShares MSCI India ETF (INDA), which gives exposure to the broad Indian equity market, seems attractive on a long-term basis.

Source: Conotoxia MT5, INDA, Daily

What about oil prices?

The main drivers of oil prices appear to be supply and demand. In the event of an emerging shortage of this commodity or problems with its supply, the price may rise dramatically, as we could see in 2022 in connection with Russia's aggression against Ukraine. According to the report, under the assumption of unchanged volumes of crude oil production by the OPEC cartel, we may see shortages of this commodity (in relation to the volume of demand) in Q1 and Q2 2023, with an average value of 0.29%. For the time being, the shortage of crude oil may be supplemented from the current stocks of the countries. Therefore, this market may be less volatile compared to the previous year.

It is forecast that overproduction could reach an average of 0.85% in the second half of this year, which could lead to lower prices for this commodity.

Source: Conotoxia MT5, XTIUSD, Daily

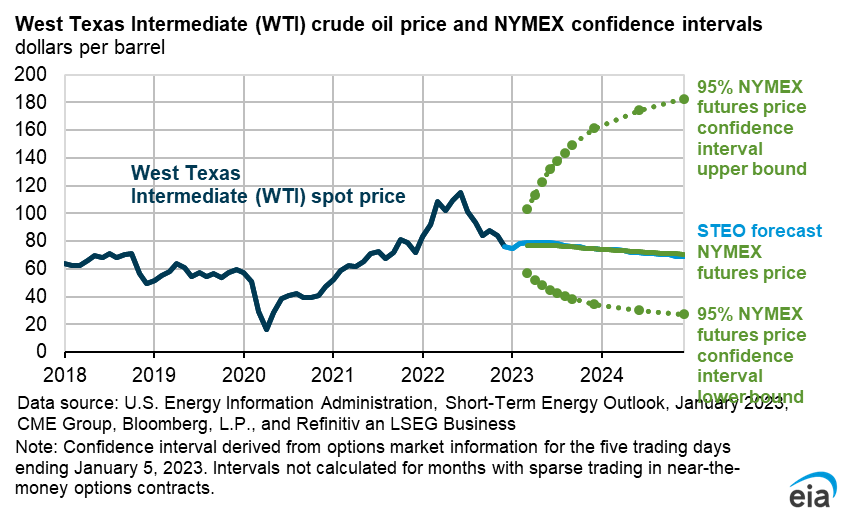

The forecast also appears to be in line with the short-term energy outlook report published by the US Energy Information Administration (EIA). The latest forecast for the average price of Brent crude oil in 2023 is USD 83.1/b, which is 5.5% below the current price of the Brent variety. This forecast is almost in line with NYMEX future oil price contracts. In addition, with 95% probability, the price of crude oil contracts is not expected to exceed USD 170/b and to fall below USD 30/b.

Source: SHORT-TERM ENERGY OUTLOOK, EIA

Situation of sanctions on Russia

A number of countries have pledged to end or reduce oil and gas imports from Russia in order to reduce Moscow's revenues and impede its war efforts. EU countries have ended oil imports by sea. A ban on importing refined petroleum products from Russia would come into force on 5 February. The US and the UK have also stopped importing oil and refined products from Russia. The oil price approved by the Western allies is designed to prevent Russia from obtaining more than $60 per barrel. The EU has also cut gas imports from Russia by two-thirds and the UK has stopped importing gas altogether. These sanctions appear to have depressed oil prices and reduced Russia's revenue from fossil fuel exports. For this reason, the decline in oil production for Russia forecast by OPEC analysts could be 7.7% in 2023. Europe's dependence on raw materials from Russia could reduce the volatility of oil prices.

Grzegorz Dróżdż, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76,41% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.