One of the more interesting markets today is the oil market. After suspecting the attacks on two tankers in the Gulf of Oman, the price of oil is surging on Thursday by almost 4 percent. This is another incident recently that may disrupt the supply of oil.

The current incident occurred a month after earlier attacks on four ships, including two Saudi tankers. At the time, the United States accused Iran, but Tehran denied the accusations, and finally no one was responsible and did not admit to the attacks. According to the current reports, a Japanese and a Norwegian tanker was probably attacked, and the incident occurred close to the Strait of Ormuz, which is crucial in the transport of oil from the Middle East.

As a result, investors stopped temporarily looking at the tense relationship between the United States and China on trade issues and their impact on a possible slowdown in the global economy, which could have contributed to a drop in oil prices around 5-month low, and began to pay attention to the supply side threat . What's more, the current events take place before the next OPEC meeting, which includes Saudi Arabia and Iran. During the summit, OPEC countries will decide on oil production levels in the second half of the year.

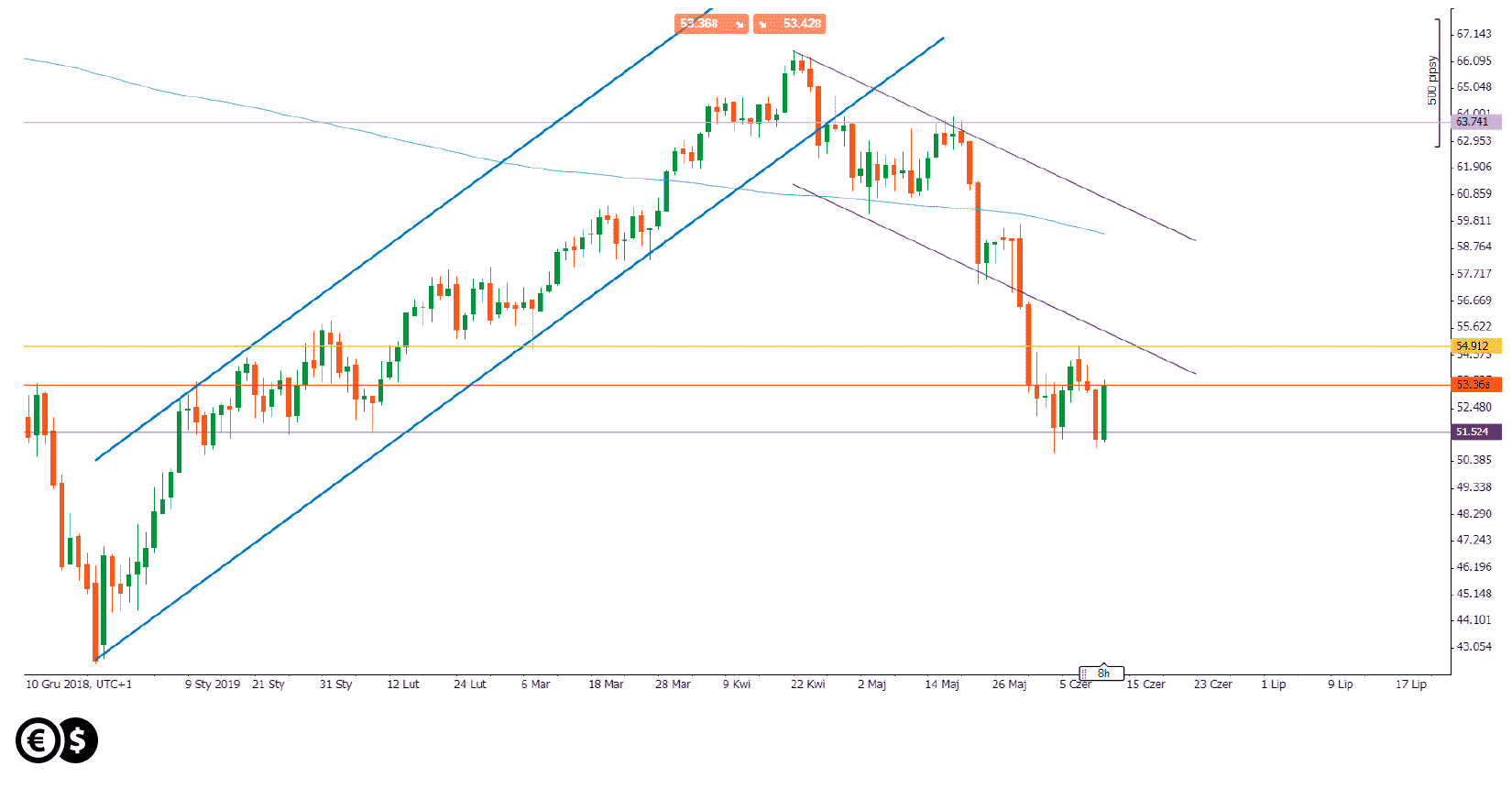

Oil WTI daily chart. Conotoxia trading platform

Looking at the chart, we can see a potential double bottom pattern, because low around 51.50 USD per barrel have been tested for the second time. The market again managed to defend this level. The nearest resistance may be in the area of USD 54,90 and the lower limit of the downward trend channel.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.