At the June meeting, the Reserve Bank of Australia (RBA) cut the main interest rate to a record low of 1.25 percent from 1.5 percent earlier. This was the first cut since August 2016, which aims to ensure employment growth, that is expected to translate into higher inflation.

Today's data from the Australian labour market did not show any significant improvement, although it is difficult to expect that monetary policy could affect it from week to week, especially as the current data relate to May. Nevertheless, the market has already begun looking for the possibility of another interest rate cut by the RBA to 1 percent. The unemployment rate in Australia in May was 5.2 percent, which means the same level as a month before. However, this is the unemployment rate higher than what the market expected. Consensus was at 5.1 percent. Australia's economy has added 42,900 jobs, and the number of unemployed has decreased by 2,400.

Due to weaker data, opinions of financial institutions have already appeared, which are quite unambiguous. JP Morgan writes that data from the labor market confirm the matter of further monetary policy easing. In turn, Bank of America ML adds that the high unemployment rate in Australia justifies the easing of monetary policy by the RBA. The interest rate market also does not have too many doubts and estimates the July cut with 70 percent probability.

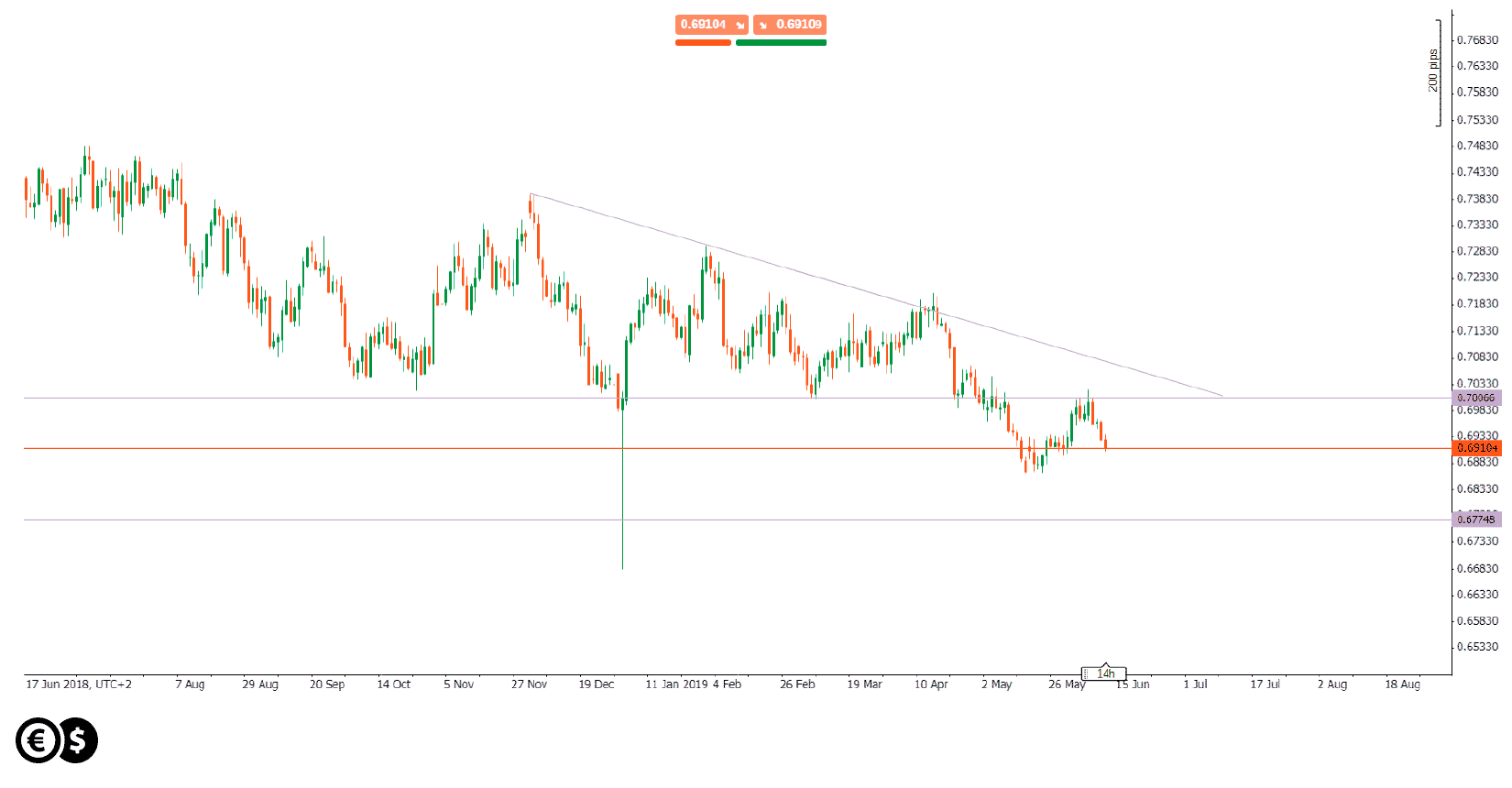

All this may affect the Australian dollar. The AUD/USD approached 0.6900, which was last observed two weeks ago. The lows from the second half of May are at the level of 0.6863, while the more significant resistance seems to be at 0.7015.

Chart: AUD/USD, D1. Conotoxia trading platform

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.