Gold, silver, stock indices, bonds - each class of assets seems to be rising today, waiting for cheap money, which can again be made available as part of global monetary policy easing. This is not a typical phenomenon when all of the main assets go up, but the possibility of flooding the market once again with cash may favor such phenomena.

The price of gold rose today by around 14 USD from 1339 USD to 1353 USD. As a result, the gold price is approaching the high from the end of last week. It was then the highest level since April 2018. Investors around the world are paying close attention to what the central bankers say this week or have already said.

President of the European Central Bank Mario Draghi gave a dovish statement on monetary policy, saying that the ECB may lower interest rates or restart the bond buying program, namely QE2. This has quite shaken the markets, and investors have begun buying shares, as well as bonds and metals and commodities.

Meanwhile, the meeting of the Federal Open Market Committee (FOMC) starts today and will end on Wednesday with a decision on interest rates, a statement, a press conference and macroeconomic projections. The market believes that the Fed will not raise interest rates at this meeting, but FOMC members may be inclined towards a more dovish position regarding monetary policy, in order to communicate a cut in the near future.

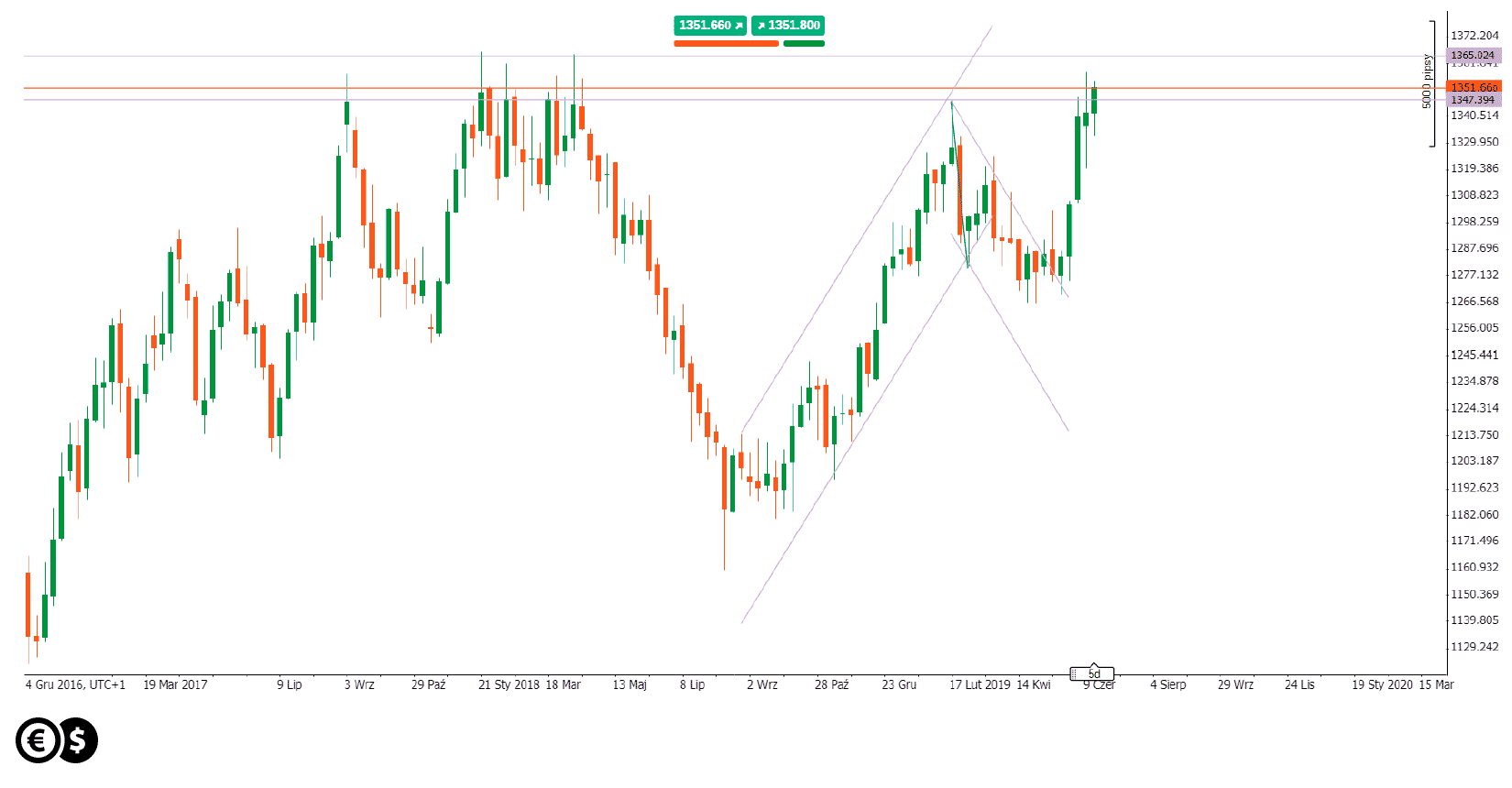

Chart: Gold, W1. Conotoxia trading platform

Looking at chart, the price of gold is approaching a significant level that previously blocked further upward movements. We are talking about level of 1365 USD. It seems that only if it is broken we may expect another rally on the gold market.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.