Gold is often treated by investors as so-called safe haven, so it is a metal that enjoys interest when anxiety increases in the world. Despite the passage of years and an increasing number of financial instruments, traditional gold is still very popular among investors.

Since the beginning of this week, risk aversion has increased due to the possibility of escalating the US and Chinese trade wars, ie increasing the value of customs duty on Chinese products. If that happened, and it may happen on Friday, China will probably retaliate to increase tariffs on US products and the conflict will build up. Investors in the stock market do not like this. Stock indices dived, and Japanese yen, which is also considered so-called a safe haven among currencies has strengthened. Gold in the context of rising risk may also seem quite attractive.

The described metal attracted attention a few weeks ago, when during the strengthening of the US dollar, in which gold is settled on the market, the price of bullion did not fall, but even increased. It can only mean one thing that gold is getting more expensive because there has been a strong demand for it. It was so big that despite the strengthening of the USD, the gold contract climbed up. This may be a sign of greater investor interest.

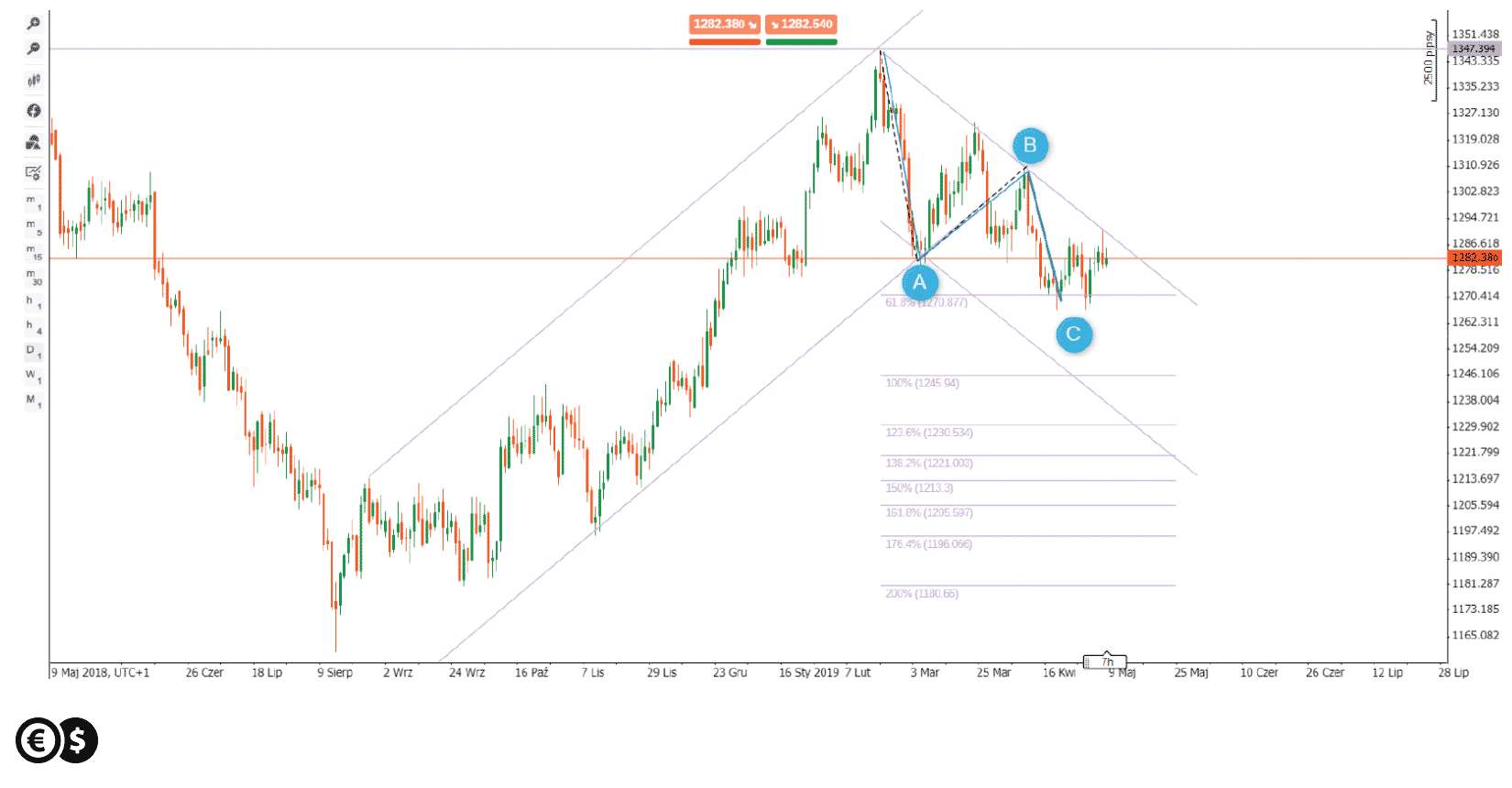

According to the chart, the price of gold could have ended the full correction labeled as ABC, where wave C stopped at the expansion of 61.8 percent of wave A. This is an important level of support. What's more, in this area there is a double bottom pattern, which is a bullish formation.

Chart: Gold, D1. Conotoxia trading platform.

However, the market has been moving within a downward channel. Its upper limit is currently an important resistance level. If it is broken the price may start a new upward movement.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.