Since the beginning of 2019, the euro has lost 2.5 percent to the US dollar. The common currency is therefore the second weakest currency this year. The first is the Swiss franc with a loss to the dollar at over 3.5 percent. Meanwhile, over the past year, the euro has lost more than 7.6 percent.

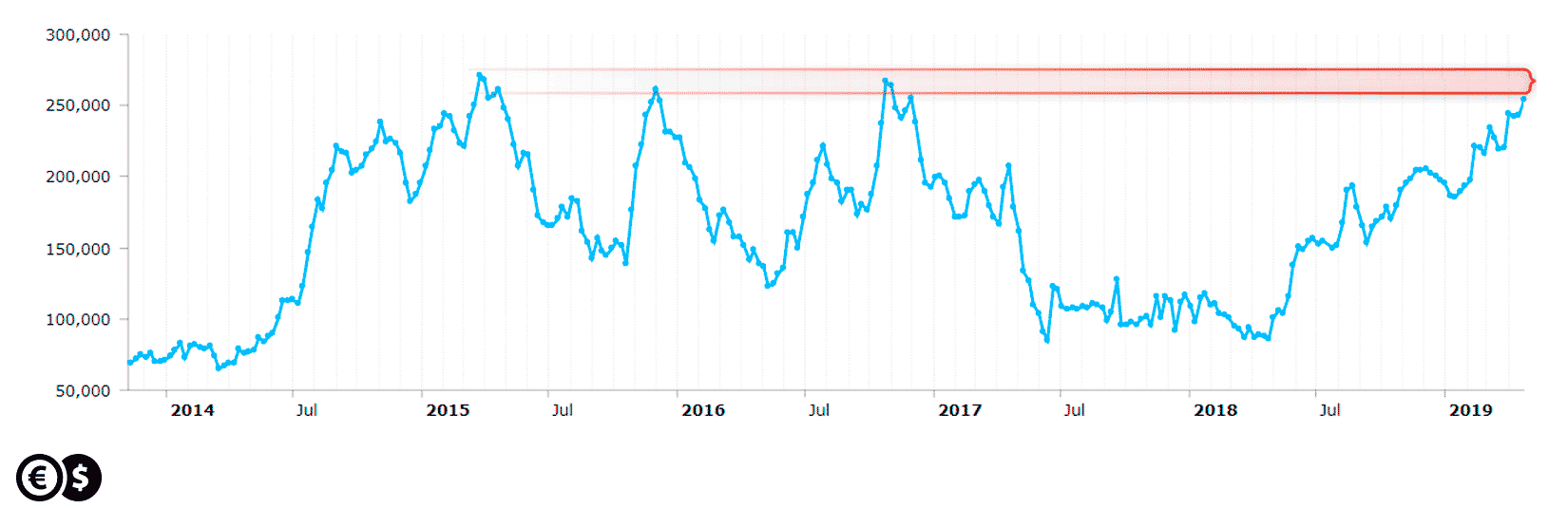

During this time, the bearish sentiment for the euro on the futures market increased - according to CFTC data published in the COT report. Non-commercial investors (speculators) increased their exposure to short positions on the euro contract to 253 749 contracts. It is the largest number of short positions since November 2016.

Chart: Euro futures - short positions of non-commercial investors. Source: tradingster.

As you can see, the short positions approached the potential oversold area. Earlier, similarly significant short positions on the decline in the value of the single currency were observed in 2015 and 2016. Both in 2015 and 2016, this led to a reduction in downward expectations. Of course, history may or may not happen again, but it is worth paying attention to the above-mentioned oversold area.

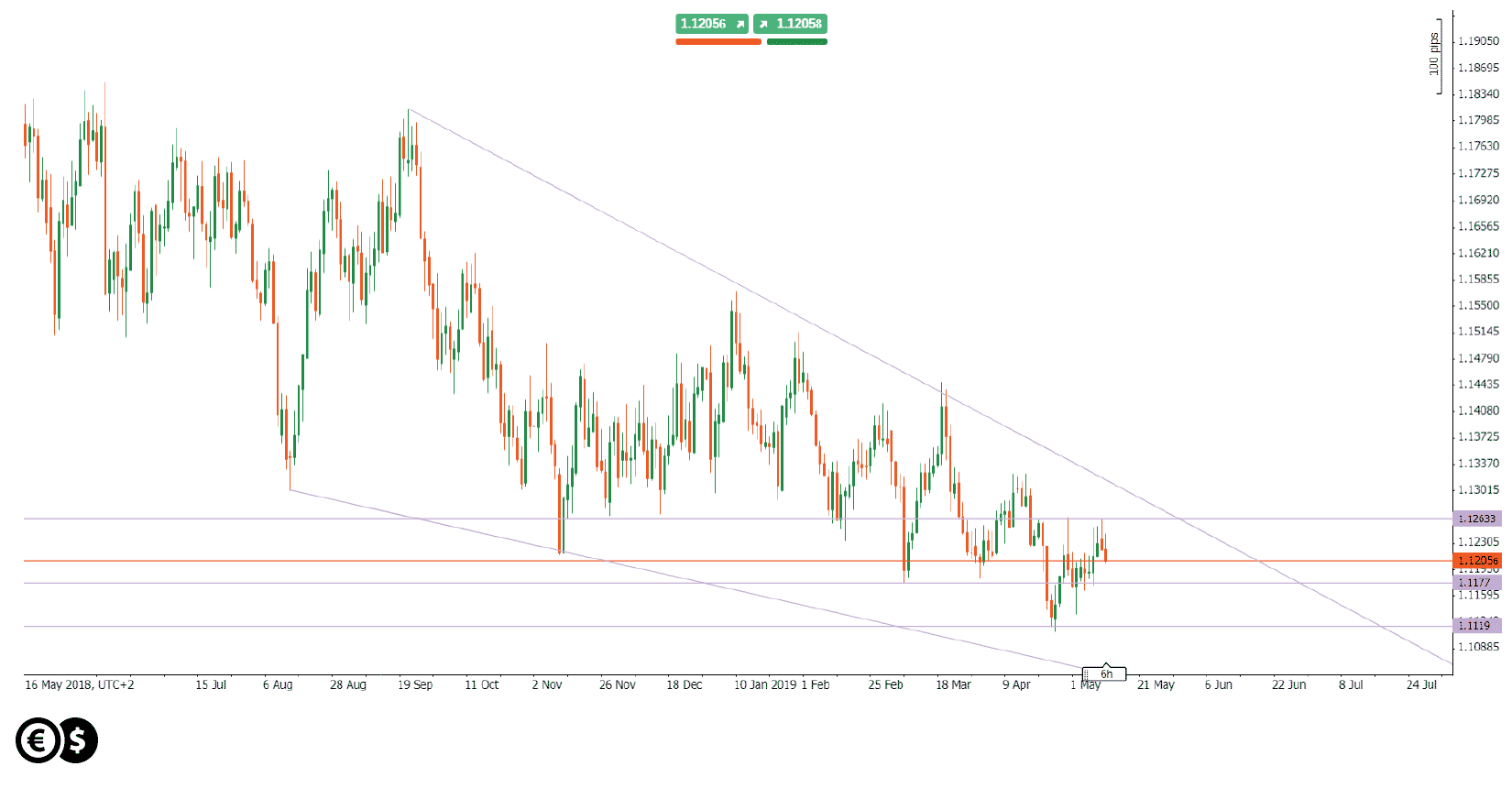

Chart: EUR/USD, W1. Conotoxia trading platform.

The EUR/USD have been trading within possible falling or ending wedge pattern. Its upper and lower limits are the first important resistance and support areas. This pattern may be a confirmation that this market is oversold. However, only a move above the upper limit in the wedge may change the sentiment from bearish to bullish.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.