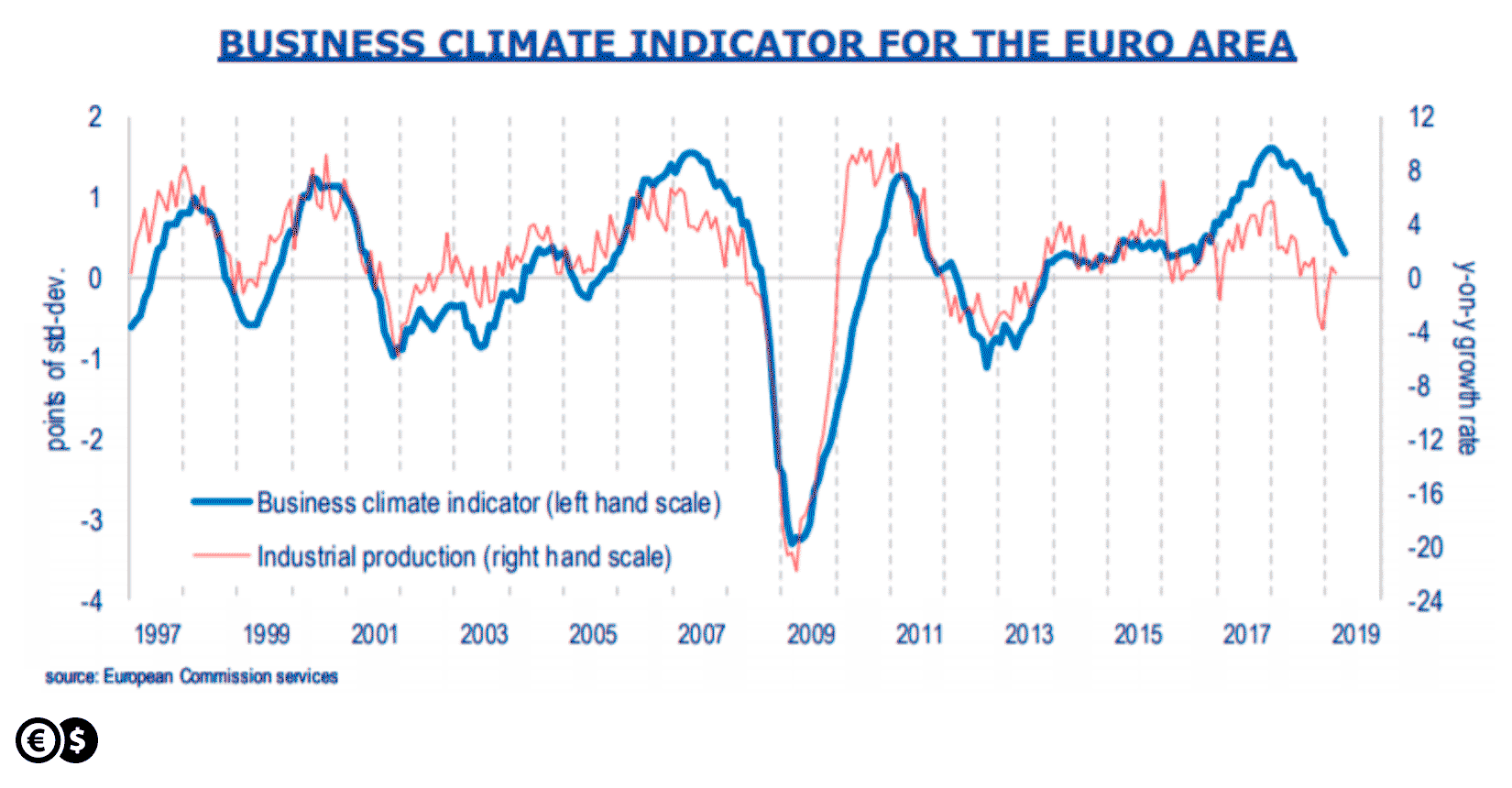

The Business Climate Indicator published today by the European Commission seems not to be very optimistic. BCI fell to the lowest level since 2016, continuing the weakening that began in 2018.

In May 2019, the Business Climate Indicator for the euro area decreased by 0.12 points to 0.30. Managers' views on previous production as well as export orders deteriorated sharply, as did their assessment of general orders to a lesser extent, while production expectations and inventory evaluations of finished products improved, the European Commission said in a note to the published data.

Business Climate Indicator for euro area and industrial production. Source: European Commission

The indicator measures the current situation of enterprises and their prospects for the future. The survey is conducted by phone and includes 23,000 companies in the euro area. The questionnaire focuses on: production trends in recent months, order books, export order books, inventories and production expectations.

We have seen such a collapse the last time during the economic crisis more than a decade ago and during the crisis in the euro area.

However, to sweeten today's publications from Europe, it is worth looking at the dynamics of lending to households and enterprises. The data was published by the European Central Bank, which may be satisfied with these numbers, because the entire central bank policy was just to stimulate lending, which in turn was to translate into a rise in inflation. The increase in loans to households accelerated to 3.4 percent in April from 3.3 percent in March, which means the highest dynamics since the beginning of 2009, according to ECB data. Meanwhile, the growth of corporate loans amounted to 3.9 percent in April, which is the highest value this year.

Therefore, despite the clear slowdown in the euro area, lending seems to be good, which may be positive news, and the new TLTRO (cheap loans for banks) may continue to support the growth of lending.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.