It seems that the process of distributing contracts for the US dollar is continuing. It may be due to the weekly data presented by the CFTC in the Commitments of Traders (COT) report.

What can this process consist in? Well, at the beginning of this year there was a strong demand for futures, which may gain as the value of the US currency increases, expressed by the futures for its index (USD Index). In over 50 percent this index includes the euro against the dollar and the following currencies: the British pound, the Japanese yen, the Canadian dollar, the Swedish krona and the Swiss franc, which is a much smaller share.

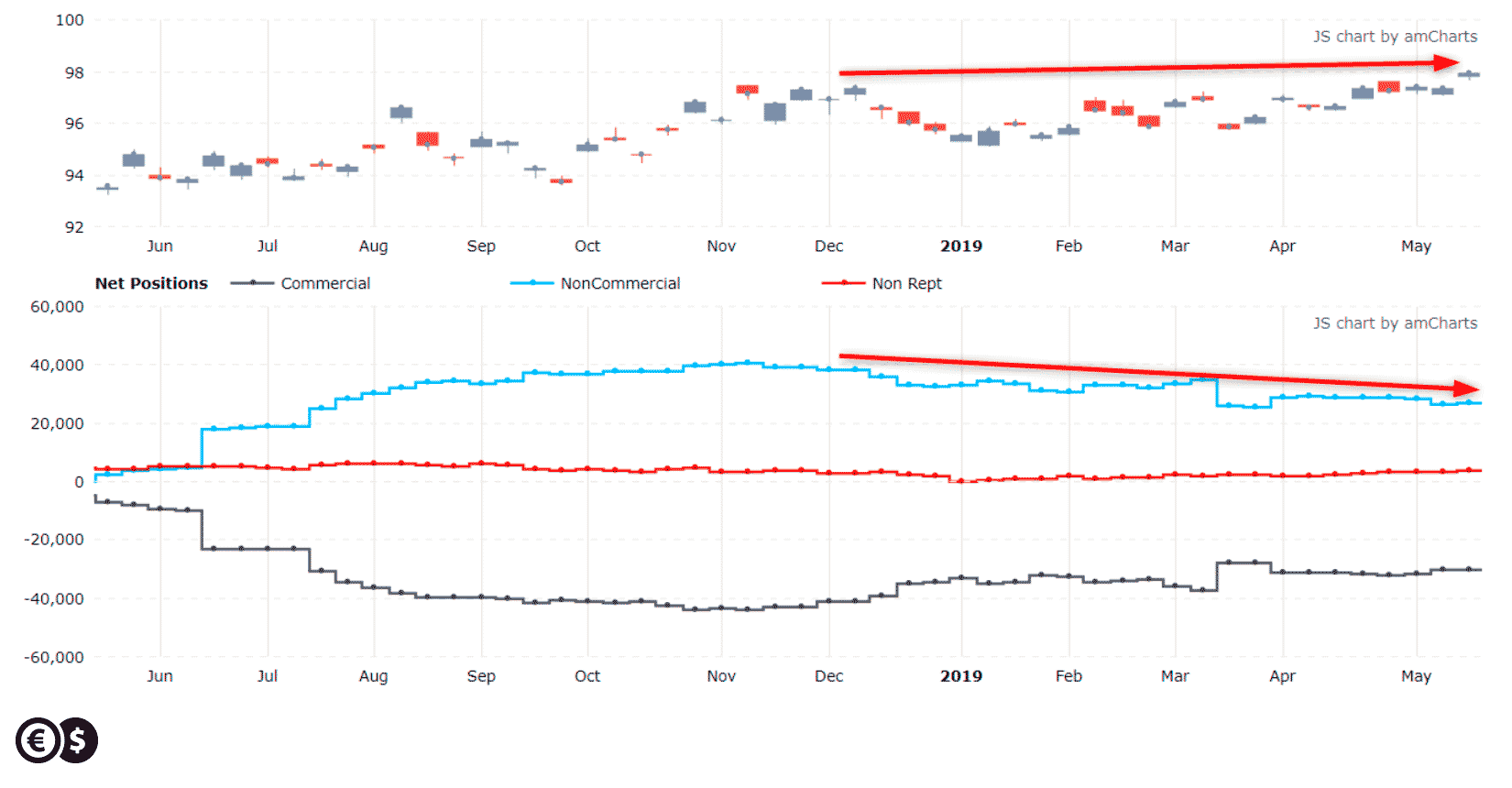

At the end of the year, with the increase in the value of the US currency, there was more demand for the dollar futures, which in turn led to an increase in the number of long net positions (long net positions indicate that there are more open contracts to increase the value of the underlying instrument). In other words, the increase in long net positions among investors speculatively focused on the market (non-commercial) coincided with the increase in the price. This is a symptom of a healthy trend.

Nevertheless, since the beginning of the year, net positions have been decreasing, and futures for the US dollar index have increased to a two-year high. This may mean the process of distribution.

Chart: USD Index futures price and non-commercial net positions.

Based on historical observations, the greater the divergence between price and positioning, the stronger the turnover on the market may be. Therefore, it is worth following the pairs with the US dollar, especially the EUR/USD, as it may seem that the potential chances for a more significant change in the trend have increased.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.