Yesterday (23.07), the listing of Ethereum ETFs in the United States took off. On the first day, after an initial spike in volatility, the price of the cryptocurrency eventually fell by 1.7%. Recent weeks have also been very volatile for ETH, but also for the market as a whole, which has fluctuated by up to 20% in both directions. Let's take a look at why this happened and what we can expect next in the crypto market.

Table of contents:

Why has no new capital flowed into the market?

Source: Conotoxia MT5, ETHUSD, H1

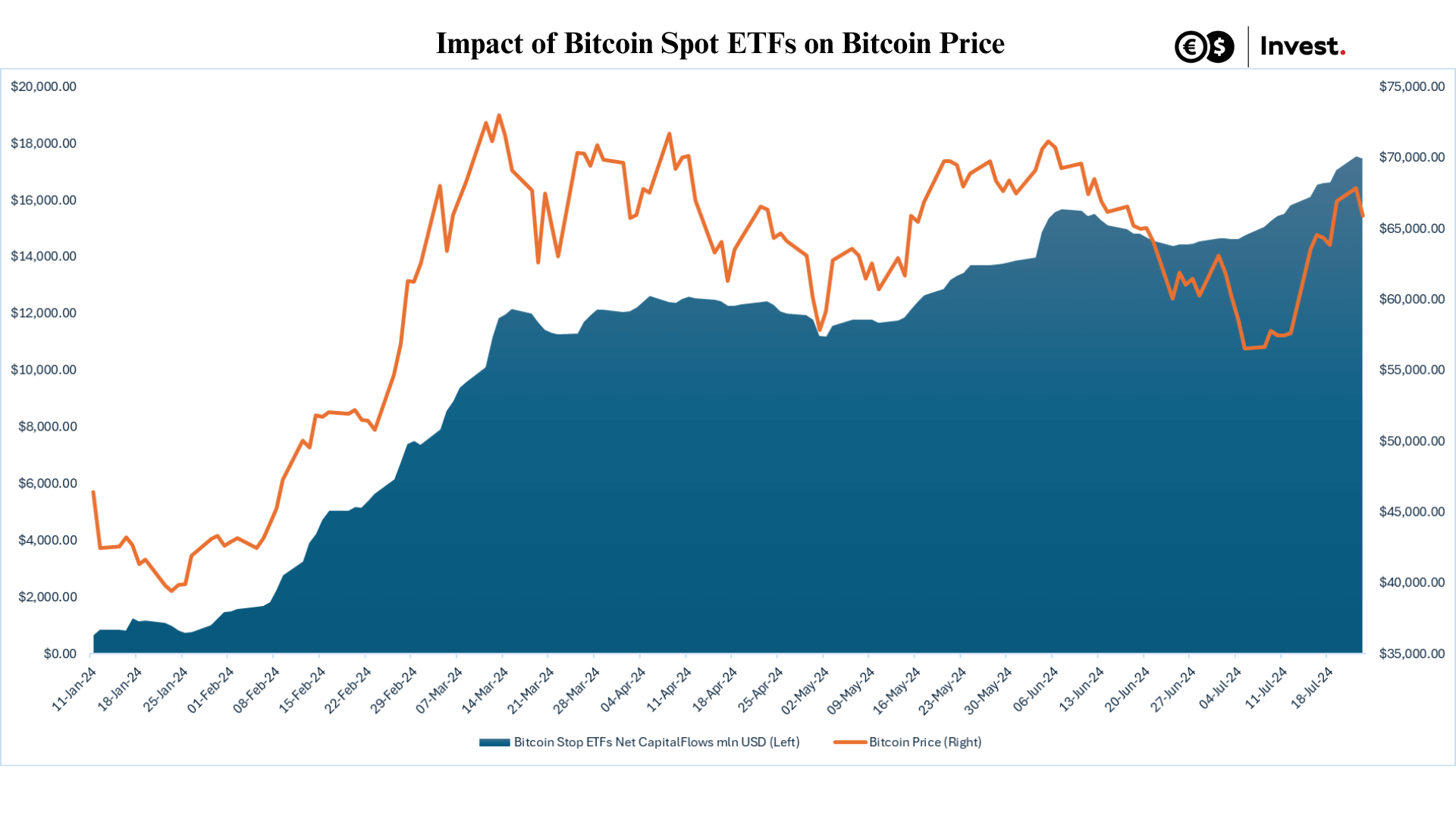

On the first day of trading, ETH ETFs generated $1.07 billion worth of transactions. However, if we look at the inflow of new capital into the funds, we see that Ethereum ETFs recorded $106.6 million net, which is more than six times lower compared to $655.3 million on the first day of trading for Bitcoin ETFs.

Source: Conotoxia Own analysis

It is worth remembering that after the launch of Bitcoin ETFs, despite the influx of new capital, the cryptocurrency saw an almost 18% decline, followed by an almost 100% rally. It is possible that we will see a similar relationship for Ethereum ETFs.

Ethereum ETFs are not new!

Although the first ETFs for ‘physical’ cryptocurrencies launched in Europe as early as 2019, the market only started to react particularly strongly to them after the US SEC approved funds for bitcoin. The approved ETFs, including products from companies such as 21Shares, Franklin Templeton, Bitwise, Fidelity, Invesco, BlackRock and VanEck, will be based on the current price of Ethereum. Management fees range from 0.15 to 0.25%, although some funds offer reduced fees during the initial period.

The biggest downside of the currently introduced ETFs is the SEC's decision not to allow the use of the ‘staking’ mechanism - crucial to the Ethereum blockchain. Staking would allow users to earn rewards in the form of new ETH tokens, resulting in an annual return of around 3%. However, ETFs can only hold ether without staking, which does not provide investors with additional returns. This makes these funds inferior to some European and Hong Kong ETFs. Nonetheless, this is still a significant development for this market, as it allows US mutual funds and financial institutions to share in the volatility in the cryptocurrency market.

Conclusions

Ultimately, although ether ETFs may not attract as much flow as bitcoin funds, they represent an important step in the development of the cryptocurrency market. They offer investors access to Ethereum's infrastructure, which could influence their future value and the acceptance of more ETFs.

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

The above trade publication does not constitute an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No. 596/2014 of April 16, 2014. It has been prepared for informational purposes and should not form the basis for investment decisions. Neither the author of the publication nor Conotoxia Ltd. shall be liable for investment decisions made on the basis of the information contained herein. Copying or reproducing this publication without written permission from Conotoxia Ltd. is prohibited. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79,03% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.