Following the failed assassination attempt on Donald Trump, financial markets reacted in a variety of ways. Fortunately, the worst-case scenario, which would most likely have led to a market collapse, was avoided. Let's take a look at how individual assets reacted to the event and what impact it may have on the stock market.

Table of contents:

Stock, gold and bond markets calm after coup attempt

The failed assassination attempt on Donald Trump has increased investor expectations of his victory in the presidential election. Polls prior to the assassination attempt were already giving Trump a lead over Joe Biden, with bookmakers increasing his odds of winning to 73 per cent. Biden is facing criticism within his own party. There is speculation about the possibility of a replacement candidate, but even that may not be enough to defeat Trump.

The Republican candidate's growing chances are being met with moderate reactions from the markets. The main US S&P 500 index opened Monday up 0.4 per cent, earlier in the day the UK's FTSE 100 index opened down 0.5 per cent from Friday's close, France's CAC 40 fell 0.8 per cent and Germany's DAX lost 0.2 per cent.

Source: Conotoxia MT5, US500, H4

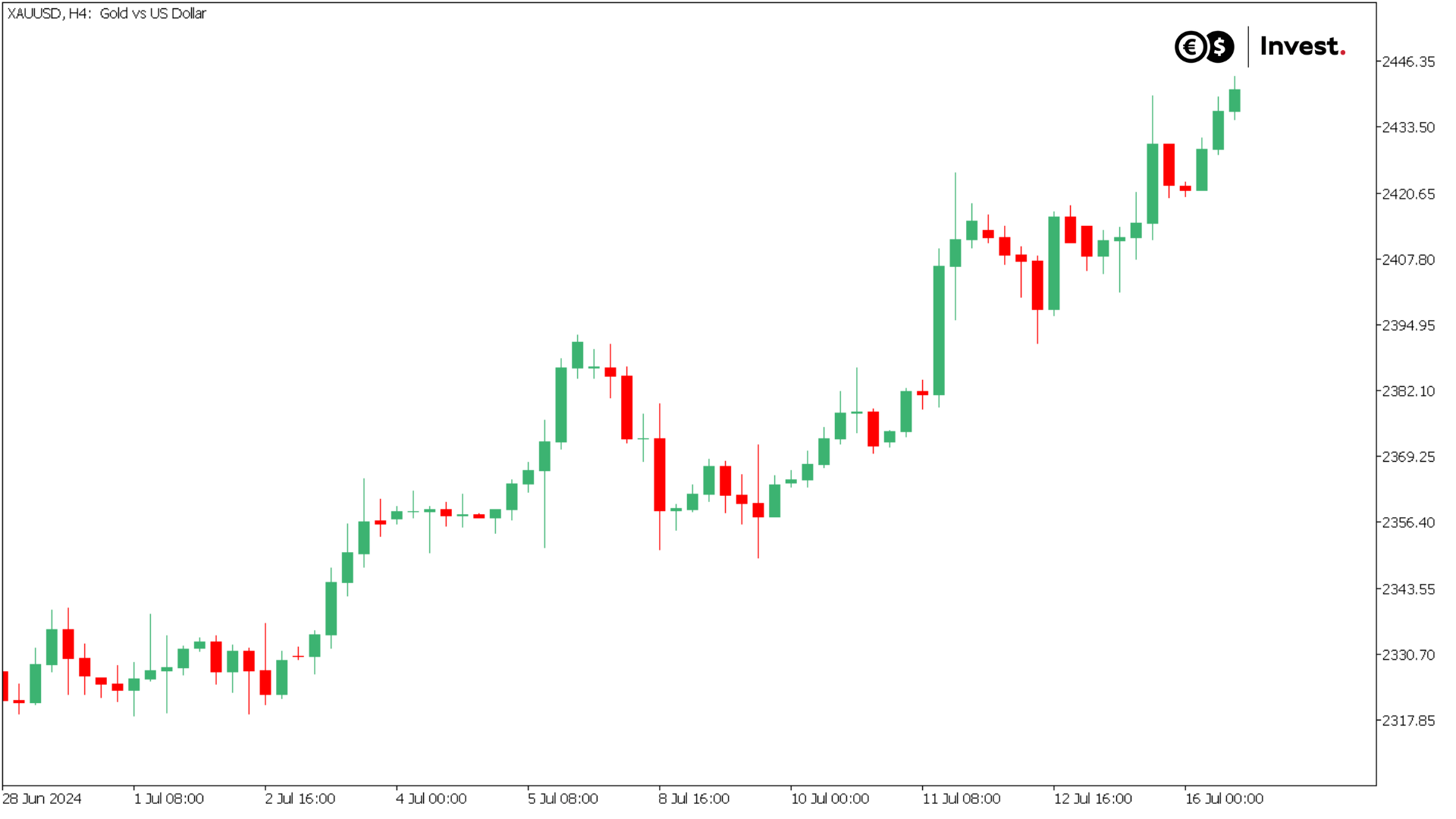

The gold price remained relatively stable, gaining 1.2 per cent from Friday's close. It seems that the assassination attempt should not have a key impact on the price movements of bullion considered a ‘safe haven’. This is most likely because an extreme scenario was avoided.

Source: Conotoxia MT5, XAUUSD, H4

The situation in the US bond market is similar. After an initial symbolic rise of 0.3 per cent, they are now 0.7 per cent below Friday's close. This means that the market is not reacting negatively to the increased chances of Trump winning.

Source: Conotoxia MT5, TLT, Daily

Cryptocurrency market boom

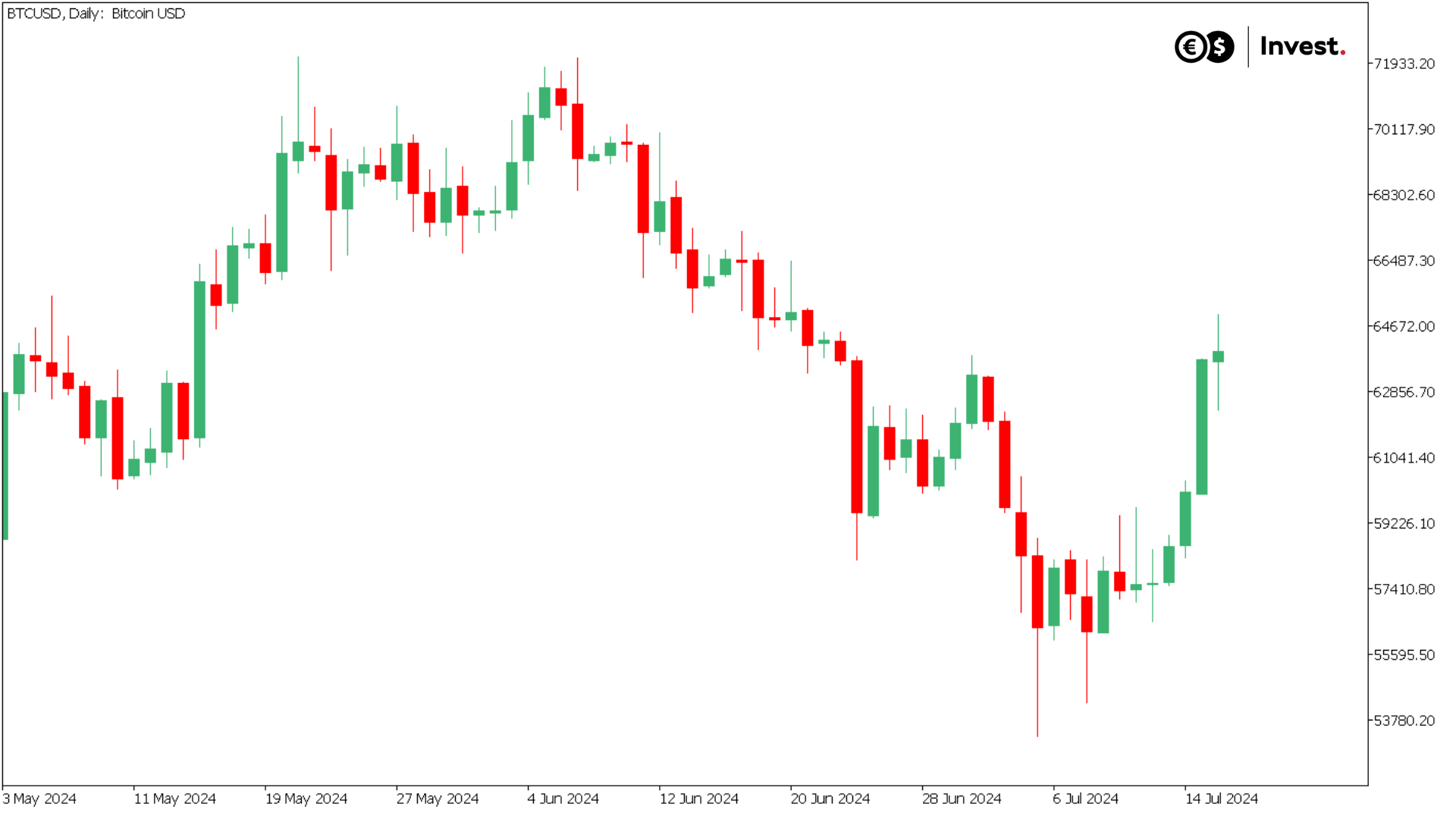

After Donald Trump's failed coup, the value of bitcoin rose, reaching a two-week high above the US$63,000 level, an increase of almost 10 per cent. Trump, who has recently begun to portray himself as cryptocurrency-friendly, is due to speak at a conference on bitcoin this month. Investors expect his presidency to bring beneficial regulation to the cryptocurrency market. Despite his earlier scepticism, Trump now accepts donations from the crypto industry and seeks to differentiate himself from Democrats who are in favour of tighter regulation.

Such a scenario could positively impact bitcoin and other cryptocurrencies in the coming weeks. We are currently in a slump in the previously booming capital inflows into this market. This can be measured by stablecoin capitalisation, which has almost frozen over the past two months.

Source: Conotoxia MT5, BTCUSD, Daily

What can we expect?

The probability of a Trump win has increased significantly, and the consolidation of one trend could positively affect stock indices and cryptocurrencies in the coming weeks. In the case of assets considered to be safe havens, such as gold or bonds, this event should not have a major impact on listings, as their fluctuations are caused by, among other things, an increase in uncertainty and a negative shock, which we are not seeing in this case.

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

The above trade publication does not constitute an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No. 596/2014 of April 16, 2014. It has been prepared for informational purposes and should not form the basis for investment decisions. Neither the author of the publication nor Conotoxia Ltd. shall be liable for investment decisions made on the basis of the information contained herein. Copying or reproducing this publication without written permission from Conotoxia Ltd. is prohibited. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79,03% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.