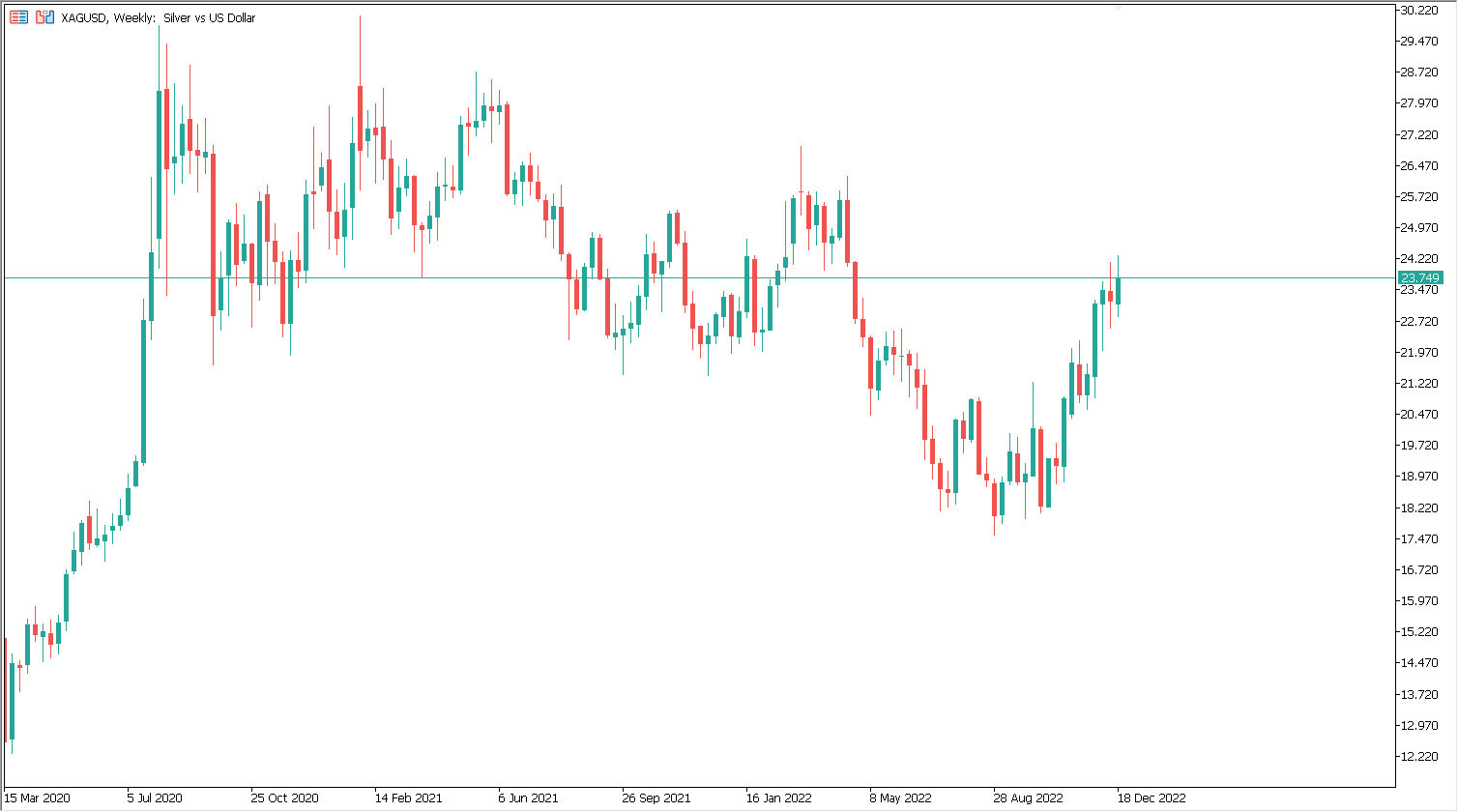

The price of silver, expressed in U.S. dollars, has risen by almost 23 percent in the last three months. Thus, of the popular markets among investors, such as stock indexes, oil, and other metals, it boasts the potentially highest rate of return to this point.

As recently as September, less than $18 was being paid for an ounce of the metal, to value it at nearly $23 by the end of December. What has changed in that time that could have led to such a rapid rise in the price of a popular alternative among investors to gold?

According to data that mints publish, there are shortages of the raw material for coin production in the United States, so there may be shortages in other parts of the economy and industry as well. However, this is not due to above-average demand at this time. Demand has been above-average twice recently, which happened in the pandemic and during the outbreak of war in Ukraine. Now, however, it seems to be more stable, and the problems may lie more on the supply side. Unlike gold, which is easily renewable and melted down for new jewelry, for example, and rarely fails to undergo some form of recycling, the same could not be said for silver. It is estimated that about 60% of silver is used in industrial applications, leaving only 40% for investment. Of that 60% used in industrial applications, almost 80% ends up in landfills. This means that with mining problems and lack of recovery of the raw material, supply problems may continue. Hence, there could be a situation where demand exceeds supply, which could have a positive impact on the price.

Source: Conotoxia MT5, XAGUSD, Weekly

For example, there are shortages of disks in the US mints, which are used to mint the popular Silver American Eagle coin. Its price is about $36. So an ounce of physical silver costs about $36, while an ounce in contract costs about $23. This creates a divergence not seen for at least a decade. From this point of view, the divergence may be reduced over time. If silver supply does not increase, it is possible that the price of silver in contracts could rise toward the valuation of physical silver.

Daniel Kostecki, Director of the Polish branch of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75,21% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.