According to the World Gold Council, Poland ranked third in terms of the amount of gold purchased in the first half of 2023, with a total of 48.41 tonnes purchased. China tops the list with 102.95 tonnes of gold purchased, followed by Singapore with 71.62 tonnes. In the second quarter of this year, the pace of Poland's gold purchases even surpassed China's, reaching 48.41 tonnes (compared to 45.1 tonnes acquired by China). The latest figures for July show that Poland has increased its holdings by around 22 tonnes of gold. Almost half of this amount is held in the vaults of the Polish Central Bank, with the remainder held by the Bank of England in London.

Where is the Polish gold stored?

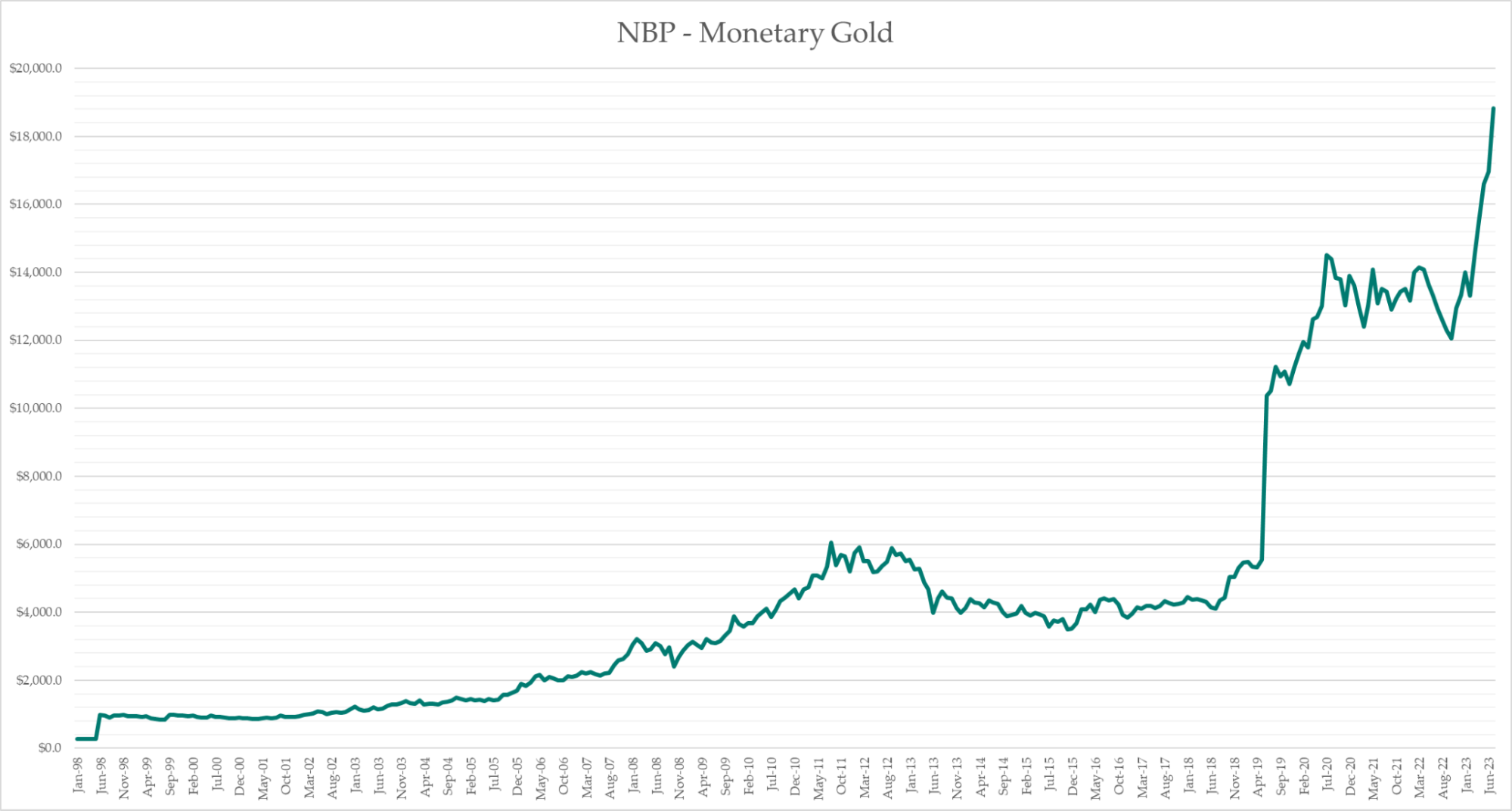

Virtually all of the gold held by the National Bank of Poland has been purchased in several tranches since 2019. After the latest purchase, gold now accounts for 10% of the NBP's total reserves. It seems that the current purchases are the realisation of the announcements made by President Adam Glapinski, who at the beginning of his term, after the first purchases, announced the acquisition of another 100 tonnes by the end of 2022. We are now almost halfway through this, which suggests that we could expect further purchases of this raw material in the coming months.

Source: NBP

Why is Poland buying gold?

The main motivation for the National Bank of Poland to purchase gold is to increase the stability of the Polish financial system and strengthen the confidence of foreign investors. The latter has been clearly eroded by high inflation (18.4% at its peak) and the rapid weakening of the Polish currency (the zloty), which has begun to recover in recent months. An additional reason is the increase in national security. Poland is one of the largest suppliers of arms to Ukraine, which is reflected in increased tensions between Poland and Russia and Belarus, with which it borders. As Glapinski put it: “Despite what some people were saying during this war, this crisis, it turned out that the rating agencies and the world are very much taking gold reserves into account because they are so safe, flexible, easy to use. There is a respect for us and our position, a confidence that comes with it."

Source: Conotoxia MT5, USDPLN, Daily

Who else is buying gold in Europe?

Virtually the only buyers of gold in Europe outside of Poland were the Czech Republic, which bought 7.6 tonnes of it in the first half of the year. Interestingly, the countries that sold the most gold were: Russia (3.11 tonnes), Germany (2.49 tonnes) and Greece (1.93 tonnes). The other central banks practically did not change their gold holdings.

Source: Conotoxia MT5, XAUUSD, Daily

Grzegorz Dróżdż, CAI MPW, Market Analyst of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.02% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.