Looking at the expectations of the Fed`s decision, it`s hard not to resist the impression that the market is very demanding, just like Donald Trump. Whenever the opportunity arises, the US president criticizes the Fed for too fast rate increases. Now it might be possible to change it.

Investors from the interest rate market assume that the US central bank will cut interest rates by four times by the end of 2020. This would reduce the cost of money by a whole one percentage point. Therefore, investors' expectations are quite large and unambiguous. This may also be indicated by the inversion of the American yield curve for a long time, especially at its short end.

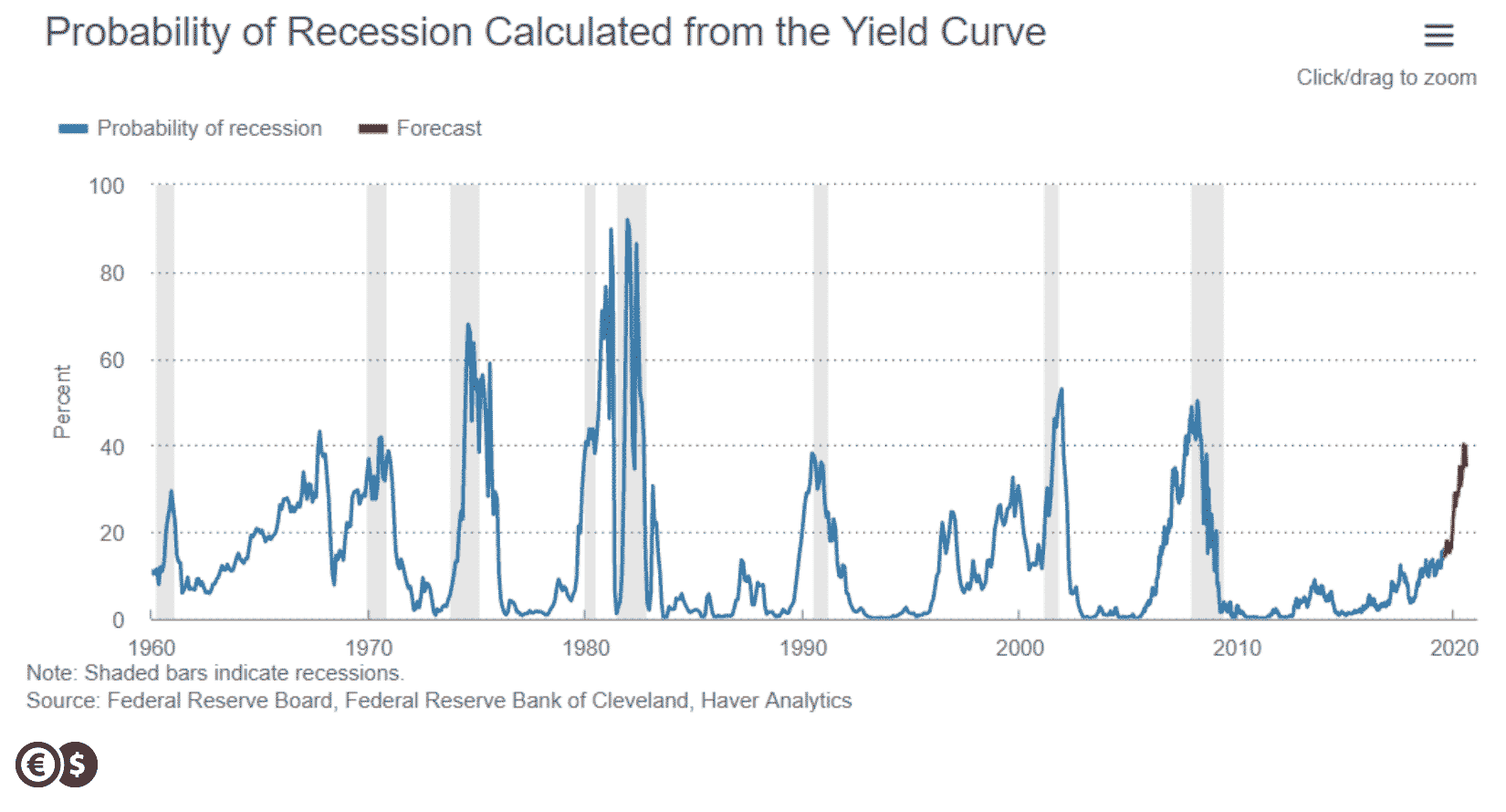

The probability of recession in the United States in 2020 calculated by the Fed branch from Cleveland has risen to 40 percent.

Source: clevelandfed.org

In the past, such a level has inevitably led to an economic slowdown and recession. There are many indications that the Fed may want to make cuts not on the basis of current data, but for fear of deterioration in the future.

Markets and investors have become so accustomed to cheap money over the past decade, and governments have been used to cheap financing thanks to low yields, and it is difficult to normalize monetary policy. In turn, any fear of any slowdown in the economy causes an immediate reaction, so that the crisis does not repeat itself.

Financial markets seem to be approaching today's decision with greater distance, and there is no significant increase in expected volatility on the FX options market. It is elevated, as is usually the case with the decisions of central banks, but there are no signs of waiting for something extraordinary. It may be different on the stock market. Wall Street seems to be counting on the Federal Reserve's dovish statement very much, and the emotions on the US stock market may be greater this evening.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.