Today marks the ECB's interest rate decision. The EUR/USD exchange rate may tremble.

Financial markets await the main event of the day. This is a decision of the European Central Bank, which may raise interest rates by as much as 0.75 percentage points to combat raging inflation more effectively. According to the rates market, the chances of such a decision stand at 65%. If such a move takes place today, interest rates in the eurozone will be at their highest level since November 2011 (1.25%).

How does the euro exchange rate trade ahead of the ECB decision?

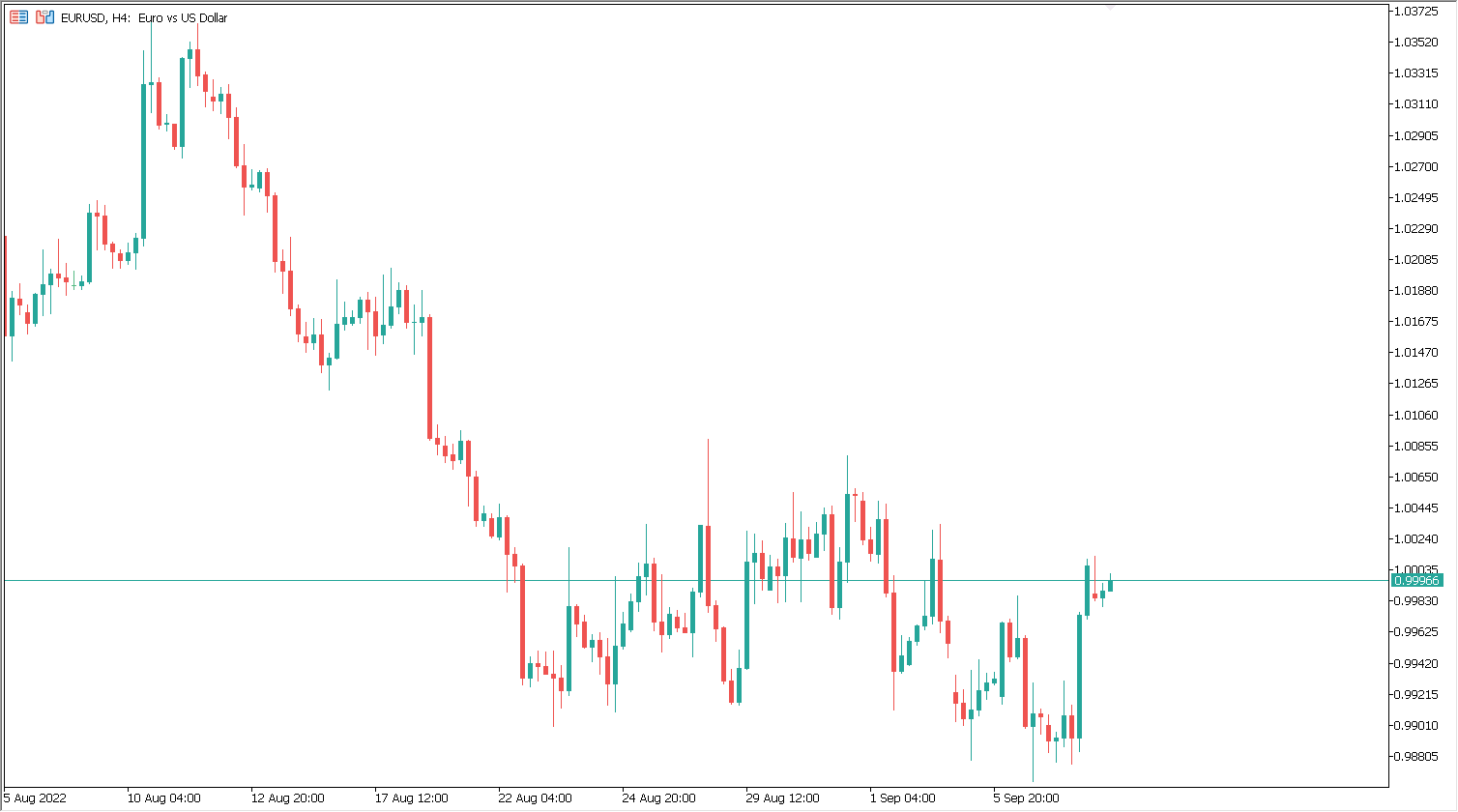

The exchange rate of the main EUR/USD currency pair is back in the 1.0000 parity region this morning, dropping -0.11% from yesterday's close on the Conotoxia MT5 platform at 07:45 (GMT+3). Today's events and uncertainty over the scale of the hike could lead to increased volatility in the EUR/USD pair, which is turning back from its lowest level in 20 years. The euro's quotations could also be affected by news from European Union leaders. Yesterday, the EU confirmed that it would impose a price cap on Russian gas while adding that the same measure would be implemented on liquefied natural gas (LNG).

Source: Conotoxia MT5 EUR/USD, H4

Key speeches by Fed representatives

Alongside the ECB decision itself, further statements by representatives of the US Federal Reserve may also be crucial for US dollar pairs' quotations. Federal Reserve Vice Chair Lael Brainard made a convincing case on Wednesday that the central bank will have to maintain its tight monetary policy until it becomes clear that inflation is moving down into the 2% target range. "It may take some time for the full effect of these tighter financial conditions to work their way through the economy (...). We are in this for as long as it takes to get inflation down," said Brainard, warning that interest rates would have to rise further. In contrast, Loretta Mester of the Cleveland Fed repeated yesterday that the central bank's monetary policy needs to enter a restrictive stance and "stay there for a while" so that inflation can cool down.

Source: Conotoxia MT5, USD Index, H4

EUR/USD in consolidation

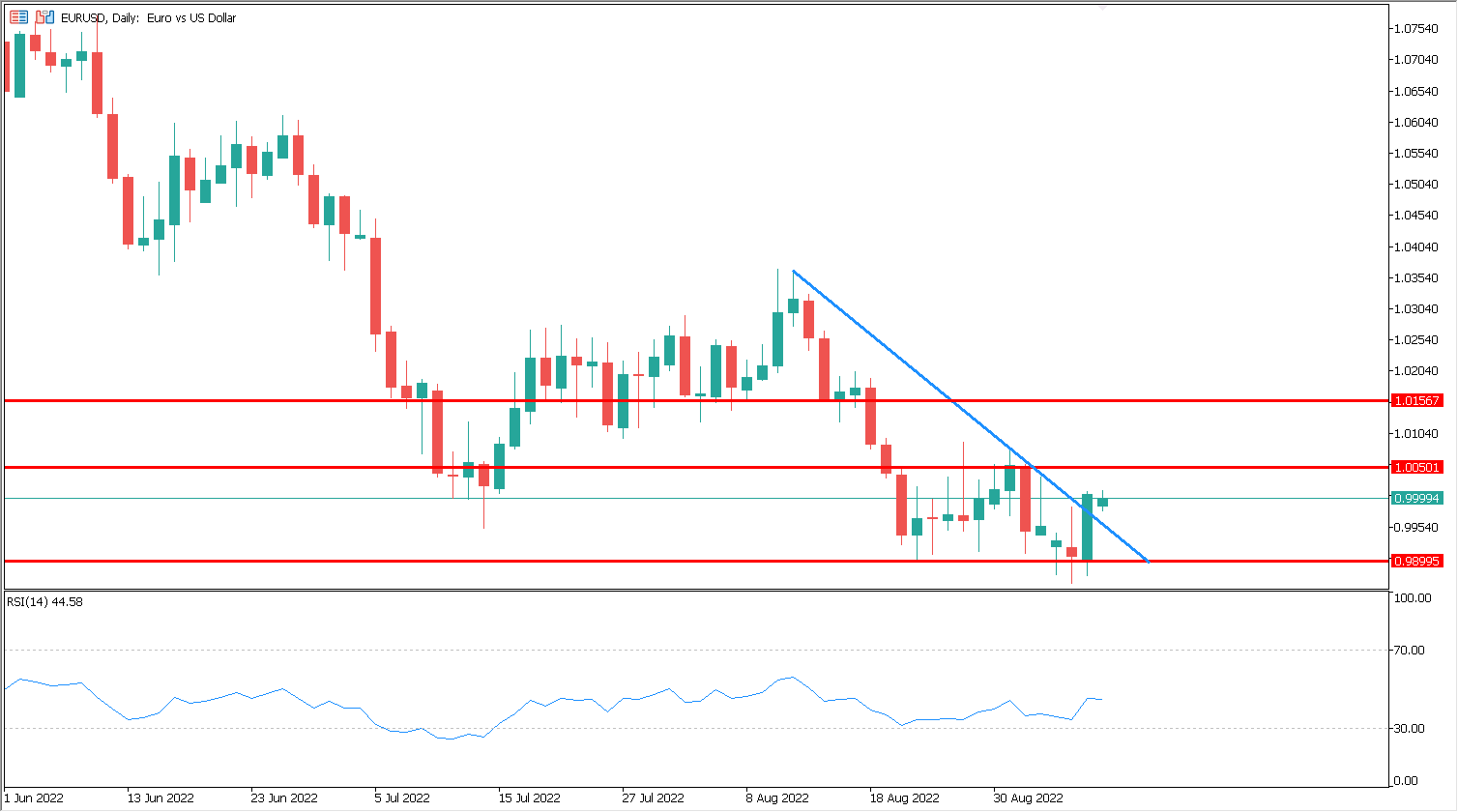

From a technical analysis standpoint, the price of the main currency pair may be in a consolidation between the levels of 1.0050 and 0.9899. However, it is worth noting that two days ago, the quotations seemed to turn back in quick time from the lowest levels in 20 years, beating the short-term trend line. On the RSI oscillator, on the other hand, a divergence may have emerged, as with the fall in the price, the oscillator level did not decrease.

Source: Conotoxia MT5, EUR/USD, D1

When to anticipate key events?

The European Central Bank's decision will be published today at 2:15 p.m.; the post-meeting press conference will start at 2:45 p.m. (GMT+3). In addition to these two events, the macroeconomic projections on inflation and GDP are also worth looking out for. These may show what path the eurozone central bank may take at future meetings.

Daniel Kostecki, Director of the Polish branch of Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.