Leading cryptocurrencies such as BTC, and ETH are experiencing a minimal correction after two strong days of gains. Tokens are losing along with equity indexes (S&P 500 and Nasdaq Composite), which rose the most in the previous session since the recovery from the Covid-19 pandemic.

What drives the last surge?

The strong movements in the markets appear to be driven by the Bank of England's intervention, requests from the UN and others to stop interest rate hikes and weak readings from the US labour market. These developments may indicate a long-awaited turn in monetary policy, and investors seem to be increasingly recognising this.

Bitcoin

After 2 weeks full of volatility and testing a possible support level of $18800 and substantial gains, the largest cryptocurrency is losing 1.1 % today on the Conotoxia cTrader platform at 11:30 UTC+2. The price, after yesterday's breakout of the 10-day and 20-day moving averages, is approaching the 50-day average, which could be local resistance. The readings of the MACD indicator seem to confirm a possible continuation of the increases. The RSI, on the other hand, is in the neutral zone and does not generate a potential overbought or oversold signal.

BTC price, daily candles

Source: Conotoxia cTrader

Ethereum

ETH is also experiencing a correction, recording a daily decline of 1.5 % on the Conotoxia cTrader platform at 11:30 UTC+2. The price of the token has lost significantly since Merge, the move to more efficient blockchain technology. After more than 1.5 months of strong gains in July and August before this event, the cryptocurrency gained a lot of room for potential declines, which eventually followed. Since its peak on 13 August, ETH has lost more than 32%.

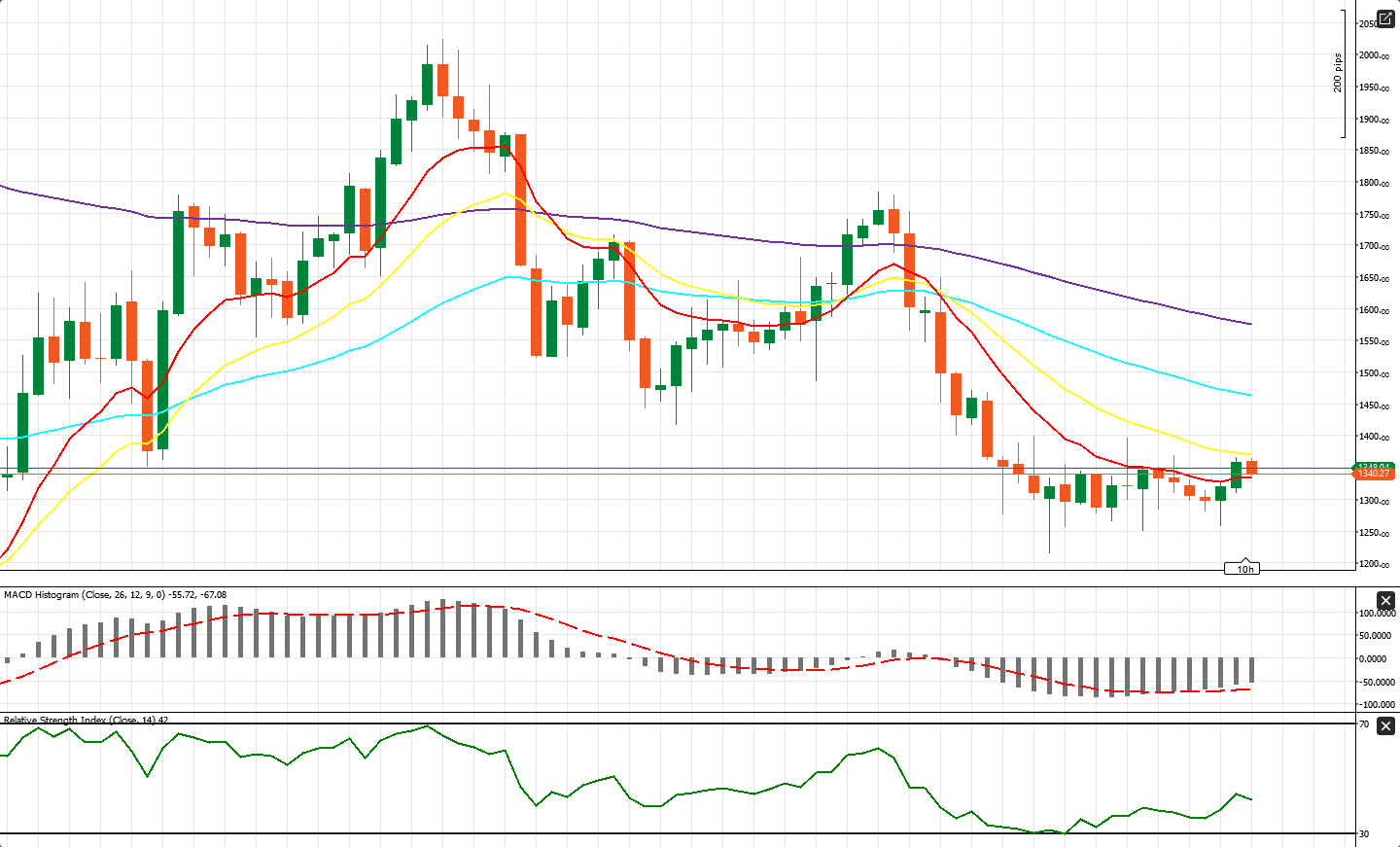

The token then tested a possible support level near $1285. The price is still below the 100, 50 and 20-day moving averages. However, the MACD indicator may indicate a potential rebound, while the RSI oscillator cannot generate a clear signal as it is between overbought and oversold levels.

ETH price, daily candles

Source: Conotoxia cTrader

Like stocks and bonds, the cryptocurrency market may be in a severe bear market. However, high inflation and expectations of an ever-closer change of course in the monetary policy of the FED and other central banks seem to indicate a possible upcoming rebound in the medium term.

Did you know that CFDs allow you to trade on both falling and rising prices?

CFDs allow you to open buy and sell positions, and thus invest when quotes rise as well as fall. At Conotoxia, you can choose from CFDs on more than 5,000 financial instruments, including more than 140 CFDs on cryptocurrencies. Wanting to find a CFD on the cryptocurrency of your choice, all you need to do is follow 4 simple steps:

- To access Trading Universe - a state-of-the-art center for financial, information, investment and social products and services with a single Smart account, register here.

- Click "Platforms" in the "Invest&Forex" section.

- Choose one of the accounts: demo or live

- On the MT5 or cTrader platform, search for the CFD cryptocurrency you are looking for and drag it to the chart window. Use the one-click trading option or open a new order with the right mouse button.

Rafał Tworkowski, Junior Market Analyst, Conotoxia Ltd. (Conotoxia investment service)

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.